Small Business Checking Accounts

We offer a range of small business checking accounts tailored to different business needs – along with a full-service digital experience designed for small business.

First Business Checking

The checking account for small business with big benefits and no minimum balance requirements.

Contact Us Contact BankerBasic Business Checking

The checking account for businesses that have larger transaction volume and maintain higher balances.

Contact Us Contact BankerBusiness Enhanced Checking

Ideal for businesses that value security, control, and performance in their daily operations.

Contact Us Contact Banker1 Standard Business Online Banking is available for no monthly fee. Additional charges may apply for certain services. See Details

2 Items include checks paid, checks deposited, deposited items and various other debits.

3 Basic Business Checking requires average collected balance of at least $5,000, otherwise $20 per month.

4 Business Enhanced Checking requires average collected balance of at least $25,000, otherwise $40 per month.

Add the Treasury Management Bundle and Protect Your Business

Safeguard your finances with three powerful security tools designed for small businesses. For only $75 per month, you get all three:

- Reverse Check Positive Pay - Stop check fraud before it happens

- ACH Positive Pay - Monitor and approve ACH debits with confidence

- ACH Lite - Send up to 50 ACH transactions monthly with ease

Get what you need to protect your payments - bundled for value.

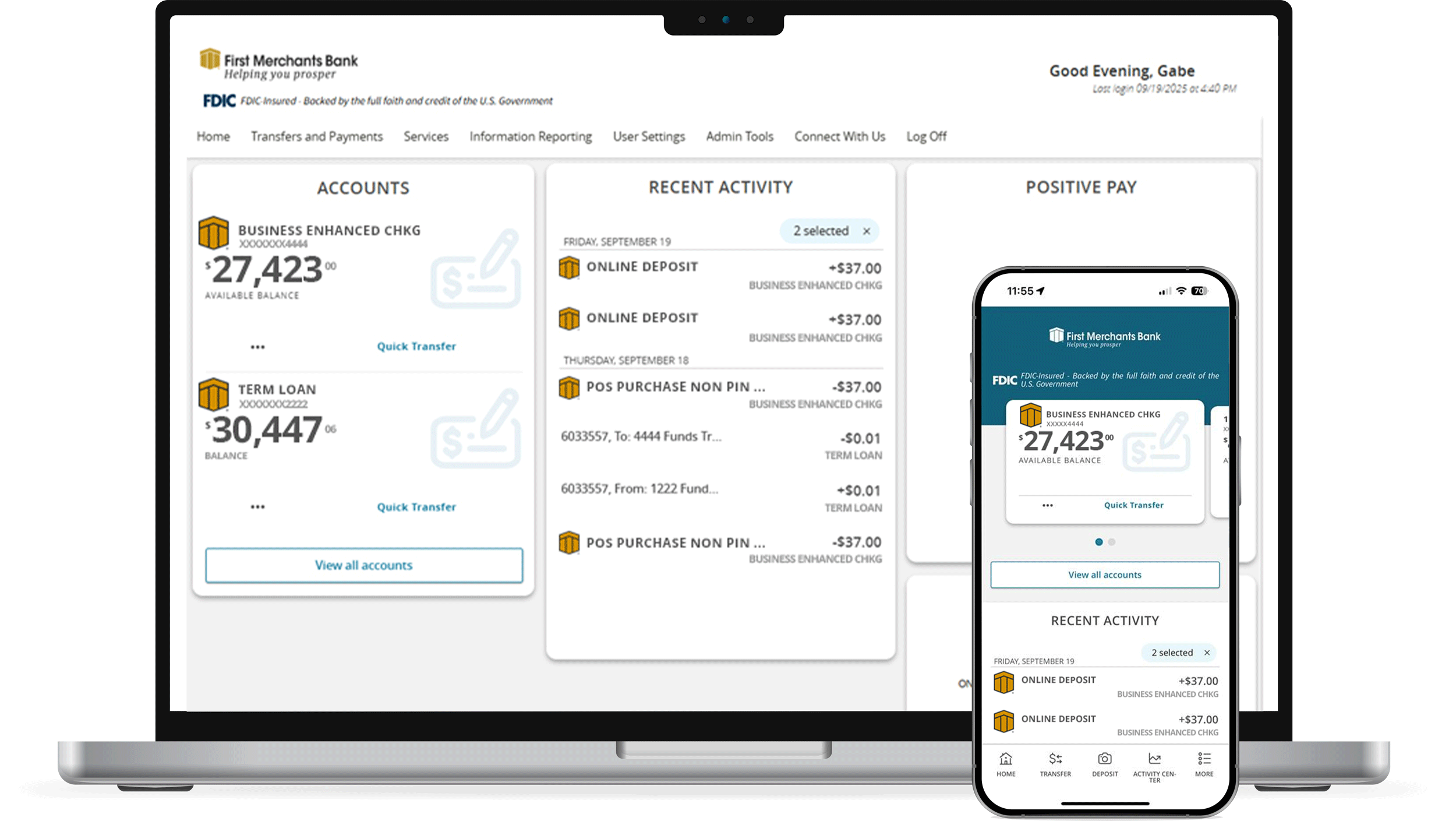

Mobile and Online Banking for

Small Business

With multi-layered security and an app designed specifically for businesses, you can easily monitor your accounts, deposit checks, select payees, and transfer money from any device.