Strategic Insights for the Year Ahead

Discover our annual perspective to help guide your financial decisions.

Private Wealth Advisors Mission: Helping You Prosper

We partner with individuals, families and organizations to provide comprehensive solutions and personal service in pursuit of a secure financial future.

We do this through:

Powerful Local Resources

Delivering broad advisory capabilities through local, engaged, and empowered leaders.

Comprehensive & Coordinated Approach

Surrounding our clients with a team of experts to deliver financial solutions focused on their long-term financial success.

Standard of Excellence

Delivering proactive service and client advocacy as we look to build powerful, intergenerational relationships. Our team of wealth managers, portfolio managers, private bankers and wealth advisors will conscientiously work with you to determine your goals and help you achieve them. We deliver expertise across multiple disciplines, ensuring you get the right solutions to help you prosper!

Letter From Private Wealth Advisors President

On behalf of our entire team, I invite you to reflect with us on another year of progress, challenge, and partnership through our annual perspective in “The Long View.” This publication remains rooted in our focus on providing comprehensive and coordinated solutions for our clients in their pursuit of a secure financial future.

2025 has been a year defined by transition and resilience. The economic landscape continued to evolve, with markets responding to changing interest rate policy, persistent inflationary pressures, and new regulatory developments driven by a new administration. While headlines often focused on uncertainty, our conversations with you—our clients, colleagues, and partners—remained anchored in clarity, purpose, and the pursuit of meaningful goals.

As Fiduciaries, we are reminded daily that true prosperity is not achieved through fleeting trends or short-term gains, but through diligence, focus, and a commitment to the long-term. This year, we revisited the fundamentals: defining what success means for each of you, evaluating risk in the context of your unique circumstances, and reaffirming timelines that support your vision for the future.

We have made continued investments in serving the unique needs of business owners, especially as they consider and execute transition strategies. Our team has expanded its expertise and resources to guide owners through succession planning, sale, and legacy-building, ensuring that each transition is approached with care, insight, and a focus on long-term outcomes.

Additionally, we are enhancing our Corporate Retirement Plan Services offering. These improvements are designed to deliver greater value, flexibility, and education to organizations and their employees, helping them prepare for retirement with confidence and clarity.

Similarly, our commitment to serving the full spectrum of financial needs of our Non-Profit clients remains unwavering. We recognize the vital role these organizations play in our communities, and we have added dedicated resources and are building tailored solutions to help them achieve their missions, steward their assets, and plan for sustainable impact.

Looking forward, we remain steadfast in our commitment to attentive, personalized service. We will continue to ask the right questions, listen intently, and rally the expertise of our team to help you achieve your goals. The coming year will undoubtedly bring new challenges and opportunities, but our focus will not waver: helping you prosper, today and for years to come.

Thank you for your continued trust and partnership. It is our honor to serve you, your families, and your organizations. We wish you a healthy, safe, and successful year ahead.

Michael B. Joyce

President, Private Wealth Advisors

As we look ahead to 2026, there is a growing sense of anticipation as the U.S. will once again be at the heart of a spectacle that declares winners and losers every four years. No, we’re not talking about the mid-term elections, but the FIFA soccer World Cup, which will arrive on U.S. soil next summer! Even as Argentina fans continue to savor the last trophy lift, we’re struck by the contrast: the world’s game brings nations together just as the economic and political backdrop is evolving toward something more fragmented. That tension between global connection and rising protectionism was one of the defining dynamics of 2025. It shaped markets, influenced policy, and set the stage for a year where discipline, diversification, and perspective mattered more than ever for investors. This Long View is our effort to distill the year’s major developments into a clear narrative and help frame what’s ahead for long-term investors.

A Policy Reset That Redefined the Narrative

Last year opened with an unmistakable shift in priorities coming out of Washington. Sweeping tariff proposals unveiled on Liberation Day, paired with the One Big Beautiful Bill Act (OBBBA) and changes to immigration enforcement, set the tone for an agenda focused on reshoring, domestic production, and stricter border controls. For businesses, the policy mix carried both opportunity and uncertainty: generous tax incentives for U.S.-based manufacturing on one hand, and rising input costs and planning ambiguity on the other. Adding to the complexity, a crackdown on immigration strained labor supply across a range of industries. The global order that had prevailed for decades, promoting integration through cooperation and trade, was put to the test. And yet the surprise in 2025 was the adaptability of the corporate sector to the shifting rules of engagement and the economy’s incredible resilience.

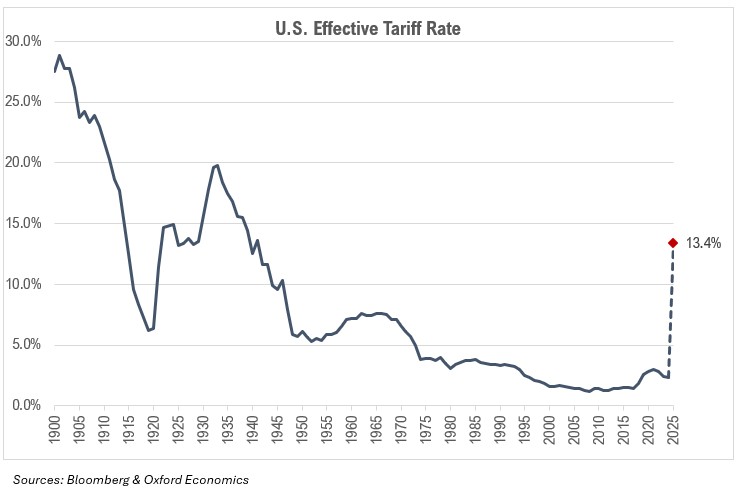

Markets spent much of the year interpreting these crosscurrents, particularly as tariff announcements, exemptions, and revisions dominated headlines almost daily. Although the U.S. effective tariff rate has been pushed to the highest level in almost a century and imports from China declined meaningfully, trade with other regions expanded as supply chains reoriented rather than collapsed. We ended 2025 with a U.S. economy that was shaken but remains on solid footing, and a global economy that also shows pockets of opportunity. Early in the year, the IMF had expected global GDP growth of 2.8% in 2025 but has now recalibrated their expectations to 3.2%. A brighter outlook in Europe is anchored by Germany’s renewed fiscal push toward defense and infrastructure. In Japan, corporate governance reforms continue to unlock shareholder value while inflation is moderating.

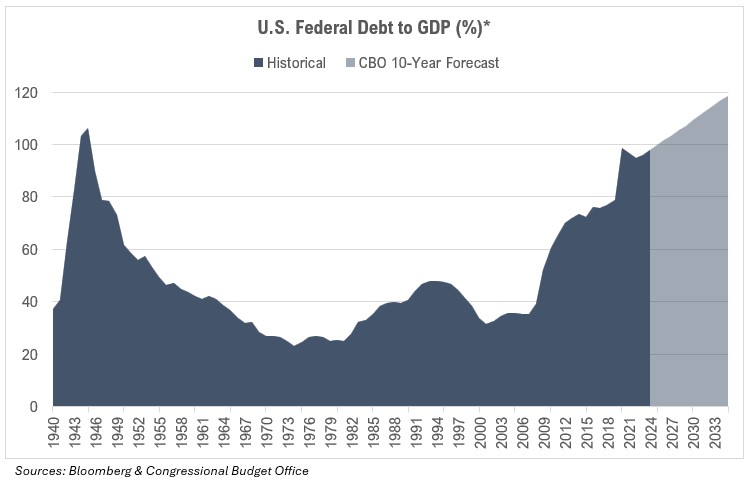

Still, the fiscal consequences of the policy reset were difficult to ignore. Fiscal projections deteriorated as increased government spending and tax cuts under OBBBA outweighed tariff revenues. Despite efforts of the Department of Government Efficiency (DOGE), deficit spending persisted at elevated levels, pushing the national debt further into uncharted territory. The interest expense on the growing federal debt pile now exceeds defense spending, a sobering milestone that underscores the structural challenges facing policymakers. These imbalances fueled debate about the long-term stability of the U.S. dollar and reinforced gold’s appeal as a hedge against fiscal uncertainty.

As policy uncertainty reshaped supply chains and investment decisions, capital increasingly flowed toward the few areas opportunity and policy support, most notably artificial intelligence.

AI’s Buildout and Financial Markets: A Tailwind With Real-World Limits

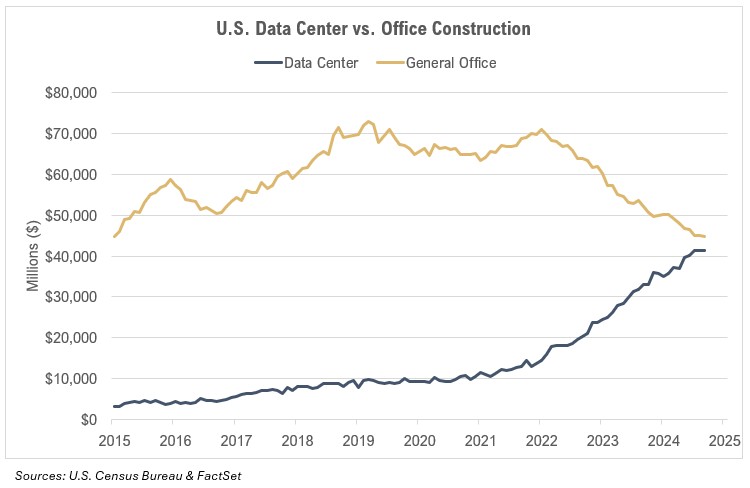

If 2023 and 2024 marked the ignition of the artificial intelligence investment boom, 2025 was the year its physical and financial footprint became impossible to ignore. Corporate spending on AI infrastructure surged to new highs as compute demand continued to outstrip supply. What changed meaningfully this year, however, was not simply the scale of investment, but how it was being financed.

In the early stages of the AI cycle, capital spending was largely funded by the balance sheets and cash flows of a handful of deep-pocketed technology leaders. In 2025, AI data center demand broadened and even some of the largest cloud titans felt the financial strain to keep pace. As a result, financing has increasingly shifted toward debt issuance, vendor financing arrangements, and off-balance-sheet structures. Wall Street analysts have pegged the ultimate bill of the AI infrastructure buildout over the coming years to be measured in the trillions. OpenAI, the rapidly growing maker of ChatGPT, has alone committed to roughly $1.4 trillion in AI data center investment, despite expectations that the company won’t be cash flow positive until at least 2029. Debt itself is not inherently problematic, but rapid growth in leverage often marks a phase where selectivity becomes more important as it introduces fragility and volatility into financial markets.

Market leadership meanwhile remained highly concentrated, reinforcing a trend that has persisted for several years. As JPMorgan’s Michael Cembalest observed in September, “AI-related stocks have accounted for 75% of S&P 500 returns, 80% of earnings growth and 90% of capital spending growth since ChatGPT launched in November 2022.” While not new in 2025, this concentration underscored just how dependent overall market performance has become on continued success in a narrow segment of the economy.

The physical constraints of the AI buildout also became increasingly visible. Rapid data center expansion strained regional power grids, drove higher electricity demand, and accelerated the need for investment across generation and transmission infrastructure. Together, these financial and operational realities marked a clear inflection in the AI cycle—one where scale, financing structure, and physical constraints became as important to market outcomes as technological progress itself.

The Federal Reserve: Navigating a Bifurcated Economy

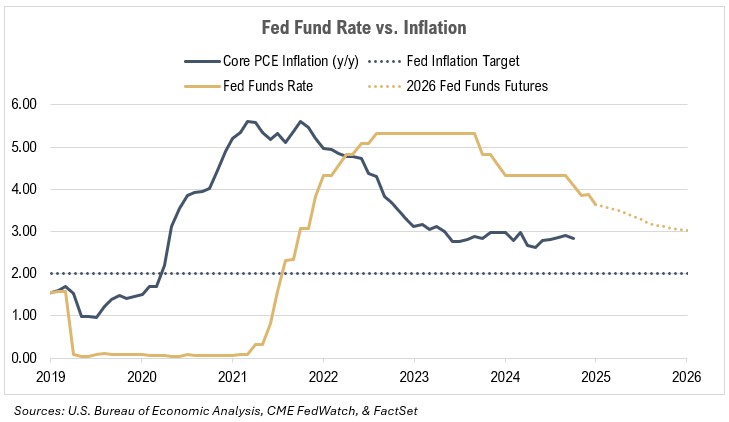

After cutting rates in late 2024, the Federal Reserve adopted a cautious and deliberate stance through much of 2025. Inflation moderated only gradually amid sticky service prices and pockets of inflation-price pressures in goods (though the broad price impact has not been as bad as feared). Throughout the year, the Fed was forced to navigate an economy that was not simply slowing or accelerating, but increasingly bifurcated.

On the corporate side, AI-linked sectors enjoyed strong earnings growth, abundant capital, and resilient demand, while rate-sensitive industries—including housing, small business investment, and discretionary services—faced higher borrowing costs and tighter financial conditions. This uneven transmission complicated the Fed’s task, as aggregate data masked significant dispersion beneath the surface.

A similar divergence emerged among consumers. Higher-income households remained supported by asset appreciation, stable employment, and greater exposure to equity markets. In contrast, lower-income households felt the cumulative weight of depleted excess savings, elevated interest rates, welfare cuts, and tariff-related price pressures on essential staples. These dynamics helped explain why consumption remained resilient in the aggregate even as financial stress increased for portions of the population.

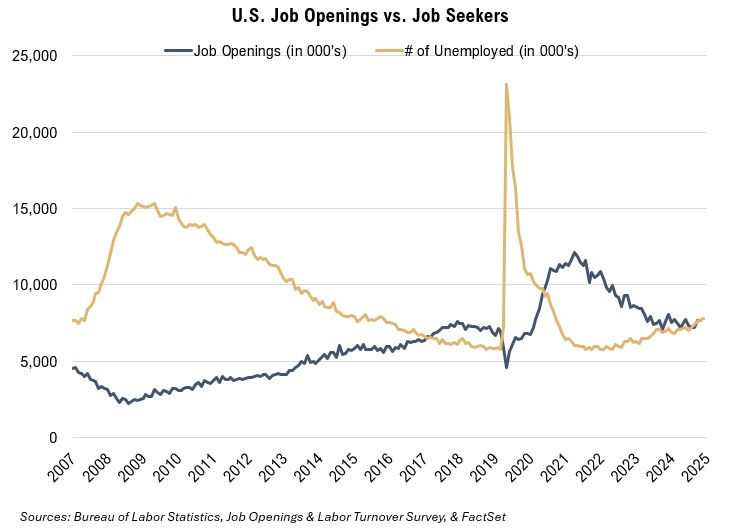

Labor markets reflected this complexity. While layoffs remained contained and employment levels stayed historically healthy, hiring slowed meaningfully, particularly affecting recent college graduates and rate-sensitive industries. Wage growth continued to cool from post-pandemic highs, easing inflationary pressure but also signaling a gradual loss of momentum.

Against this backdrop, the Fed held policy steady through much of the year before resuming rate cuts late in 2025 as labor market conditions softened just enough to provide cover, even with inflation still above the 2% target. By year-end, the central bank had reduced rates at the final three meetings, while clearly communicating a more restrained path for 2026 as the full effects of fiscal and trade policy continued to work through the economy.

Rates, the Dollar, and a Repricing of Fiscal Reality

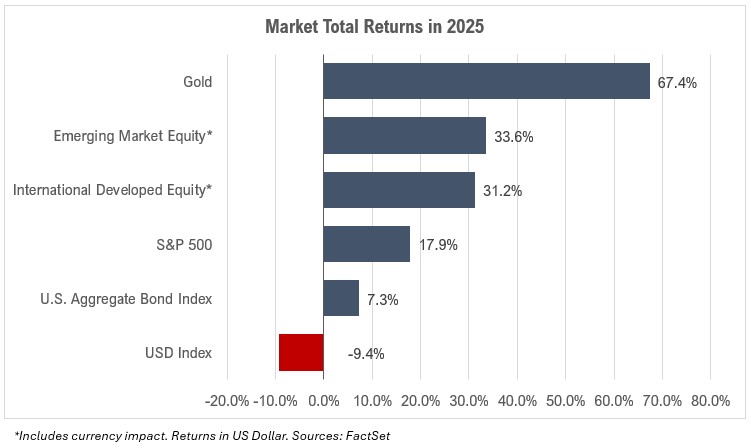

Markets responded to these crosscurrents by reassessing long-term fiscal and monetary assumptions. The U.S. dollar weakened during 2025 amid shifting global capital flows and heightened concern over persistent deficits, while gold benefited from demand as a hedge against fiscal uncertainty. International equities—particularly in emerging markets—outperformed U.S. stocks, supported by more attractive valuations and incremental improvements in growth expectations alongside currency tailwinds.

For U.S. investors, the takeaway was not that leadership has permanently shifted abroad, but rather a timely reminder that valuation matters, returns are cyclical, and global diversification remains essential, especially in an environment where policy, growth, and inflation signals point in different directions.

Helping You Prosper

We partner with individuals, families, and organizations to provide comprehensive solutions and personal service in pursuit of a secure financial future.

Financial and Estate Planning and Fiduciary Services

Financial and estate planning is a crucial yet often overlooked part of financial management. Through personalized consultations, we develop tailored strategies and solutions with a generational approach to planning. Our team brings expertise in business succession planning and provides collaborative support with attorneys, accountants, and other trusted advisors to ensure every decision works in harmony.

Investment Management

Our investment management approach begins with developing a personalized investment policy statement that reflects your goals and risk tolerance. From there, we create tailored portfolios designed to support long-term success, upholding our fiduciary responsibility at every step. With diversified equity and fixed-income strategies, access to experienced research and management teams, and disciplined, fee-based portfolio oversight, we provide a structured framework to help you navigate market shifts with confidence.

Professional Services

Our Professional Services deliver customized strategies designed to support physicians, attorneys, and other high-income professionals with complex financial needs. We create unique financial health plans that may include a complimentary financial review, private banking deposit solutions, specialized mortgage programs, lines of credit, and practice buy-in financing. Through a personalized approach, we help ensure you have the financial support and structure to thrive in every stage of your career.

Corporate Retirement Plan Services

Corporate retirement plans play a vital role in attracting and retaining employees, and we offer flexible solutions suited to businesses of any size. You can start a new plan or seamlessly transfer an existing one while exploring a wide range of options with our expert guidance. These plans offer meaningful benefits—including potential tax savings, stronger employee retention, and more secure retirements for all.

Private Banking

Private Banking offers exclusive services designed to simplify and strengthen your financial life. We provide preferred depository accounts for personal cash management, along with specialized credit solutions for professionals. With custom financing options—including lines of credit, home equity lines, and specialized mortgages—as well as tailored lending for both personal and professional investments, we deliver flexible support for your evolving goals.

Nonprofit Banking

At First Merchants, we believe nonprofit banking is about more than transactions—it’s about fueling missions that strengthen communities. Our comprehensive solutions start with tailored depository accounts and operational tools that simplify day-to-day banking, safeguard resources, and support growth. From flexible financing to strategic guidance, we help nonprofits build financial resilience and focus on what matters most—their impact.

To further support nonprofit leaders, we are launching a complimentary four-part Nonprofit Training Series in 2026, providing practical insights to help organizations thrive.

Business Succession

Business succession planning requires a tailored, conscientious approach that helps owners prepare for the future and protect what they’ve built. Our team collaborates closely to align goals, support retirement readiness, and design transition plans that provide continuity for employees, customers, and your broader legacy. With coordinated expertise across commercial banking and private wealth, we guide business owners from early planning through successful transition.

A recent engagement demonstrates this integrated approach. What began as expansion conversations in 2019 grew into acquisition financing, treasury support, and personal lending solutions as the client’s business evolved. When succession planning became a priority, our team modeled sale scenarios, coordinated with external advisors, and simplified key decisions. Even when an initial sale fell through, we remained closely involved, supporting the renewed process and post-sale planning that followed.

Today, the owner has consolidated assets with our advisors, secured needed financing, and continues to partner with us for long-term planning. This story reflects how thoughtful coordination and steady guidance can help business owners navigate major transitions with a clear, well-supported plan for what comes next.

Looking ahead to 2026, it appears the worst of the policy shocks to the economy are behind us, and it should benefit from continued phasing in of the OBBBA stimulus. Another source of reduced uncertainty is the expected appointment of a hand-picked successor to Chairman Powell, signaling a more predictable Fed policy environment. Presumably, the new Chair will agree with the President’s desire to see lower interest rates. Should labor market conditions deteriorate into 2026, this will become the lynchpin in the Fed’s case to pursue additional rate cuts.

Overall inflation moved largely sideways through much of 2025 and remained stuck in the high-2% range by year-end, with continued pressure from shelter and services costs preventing a cleaner return to the Federal Reserve’s target. The labor market, though resilient, shows signs of cooling, with the unemployment rate edging up to 4.6% in November and job openings declining from their 2022 peak. Wage growth, as measured by the Atlanta Fed Wage Tracker, slowed to 4.1% year-over-year, down from 6.7% at the height of the post-pandemic recovery.

The path of interest rates and financial conditions will play an increasingly important role in shaping the next phase of the AI investment cycle. There is good visibility into continued capacity expansion in 2026, as a substantial portion of AI-related investment has already been committed. The more consequential question is the trajectory of investment beyond 2026, which is likely to be shaped by the ability of these projects to demonstrate tangible returns this year. Following the surge in debt financing, investors are placing greater emphasis on monetization, productivity gains, and balance-sheet sustainability. This evolution does not diminish the long-term promise of AI, but it does raise the bar, widening the dispersion of outcomes and shifting market leadership toward companies that can translate investment into durable earnings growth, while tempering expectations for uniform gains across the broader AI ecosystem.

Geopolitical concerns and national security interests are increasingly shaping policy interventions in support of AI leadership, particularly in the context of U.S.-China competition. The U.S. government expanded export controls on advanced semiconductors and increased funding for domestic chip manufacturing, while new alliances—such as the Quad (U.S., Japan, India, Australia) and the EU-U.S. Technology Council—have focused on securing supply chains and protecting critical infrastructure. The transition from a uni-polar to a multi-polar world is accelerating, with trade and investment flows increasingly determined by security considerations rather than pure economic efficiency.

While the sky is the limit for AI investment ambitions, energy infrastructure needed to power the buildout remains a critical bottleneck constraining the pace of growth. Utilities and grid operators have announced over $200 billion in planned upgrades through 2030 but permitting delays and supply chain constraints have slowed progress. The North American Electric Reliability Corporation (NERC) warned in its 2025 report that at least 30% of U.S. regions face elevated blackout risks during peak demand periods, primarily due to data center growth and extreme weather events.

Rising electricity costs and strain on the utility system will push AI further into the public eye ahead of the upcoming mid-term elections in November 2026. Mid-terms may bring about a more stable policy environment, as both parties have signaled a willingness to compromise on key fiscal and regulatory issues. However, the evolution of foreign demand for U.S. Treasuries and the trajectory of the dollar remain critical variables. Although the dollar was weak in 2025, it remains elevated by historical standards and could be at risk for continued weakness if deficits persist and foreign inflows do not recover.

Taken together, the evolving policy backdrop, interest-rate environment, and maturation of the AI investment cycle point to a shifting landscape for U.S. equity markets in 2026. While artificial intelligence remains a powerful long-term driver of growth, the next phase is likely to be marked by greater dispersion and a bumpier path for returns as investors place more emphasis on execution, capital discipline, and valuation. Lower interest rates, combined with fiscal support, should encourage broader participation in the equity market beyond AI-related companies. Small and mid-cap stocks, which lagged in 2024–25, are poised to benefit from improved credit conditions and a more stable policy backdrop.

Our constructive case for bonds played out in 2025, with the Bloomberg U.S. Aggregate Bond Index returning 7.3% as yields stabilized and credit spreads remained tight. In a declining rate environment, we expect bonds to continue providing attractive risk-adjusted returns and valuable diversification. Similarly, our positive outlook on international stocks was validated in 2025, and we believe the case for global diversification remains strong as relative valuations and earnings growth prospects favor select overseas markets.

We remain grateful for the trust you place in First Merchants Private Wealth Advisors. As we head into 2026, we’ll continue partnering with you to navigate uncertainty, uncover opportunity, and keep your financial goals at the center of every decision.

Thank you for your continued partnership, and here’s to a prosperous 2026.

The Intent Behind Your Money: An Attentive Approach to Managing Your Assets

Wealth management is complex.

Beyond the intersection of tax, accounting, and legal factors, there’s another essential reality: protecting and building your wealth is deeply personal.

Every figure on your balance sheet reflects a heartfelt intention—whether you’re safeguarding your family’s future or preserving the legacy entrusted to you.

At First Merchants Private Wealth Advisors, we understand both the financial details and the aspirations behind them. That’s why we begin by listening. Thoughtful questions guide our discovery, helping us understand what your assets represent and how they can support the future you envision.

With this insight, we craft an adaptive plan tailored to your needs. Grounded in proven strategies yet flexible enough to evolve with changing markets, your plan reflects the expertise of our team and the perspective of trusted external advisors when needed.

This year, we strengthened that expertise even further. With the launch of our Nonprofit Banking division and continued investment in Retirement Plan Services, we’re better equipped to support what matters most to you.

Your First Merchants advisors bring the talent and resources to help preserve and grow your assets while supporting the legacy you’re building—with one goal always in mind: attentively helping you prosper.