Budgeting is an essential part of managing your finances, but it’s also one of the most challenging aspects. The thought of creating a budget can be overwhelming, especially if you are unsure of what steps to follow. The good news is that if you bank with us, you have a helpful budgeting tool right at your fingertips—Personal Finance, in your First Merchants Online Banking and Mobile App.

Track Your Income and Categorize Expenses

The first step in any budget is understanding how you currently spend your money. Once you have set up Personal Finance in the First Merchants Mobile App, you can use it to start grouping your expenses into categories. For example, you could have categories for rent, groceries, utilities, transportation, entertainment, and savings.

Assign a Percentage or Amount to Each Category

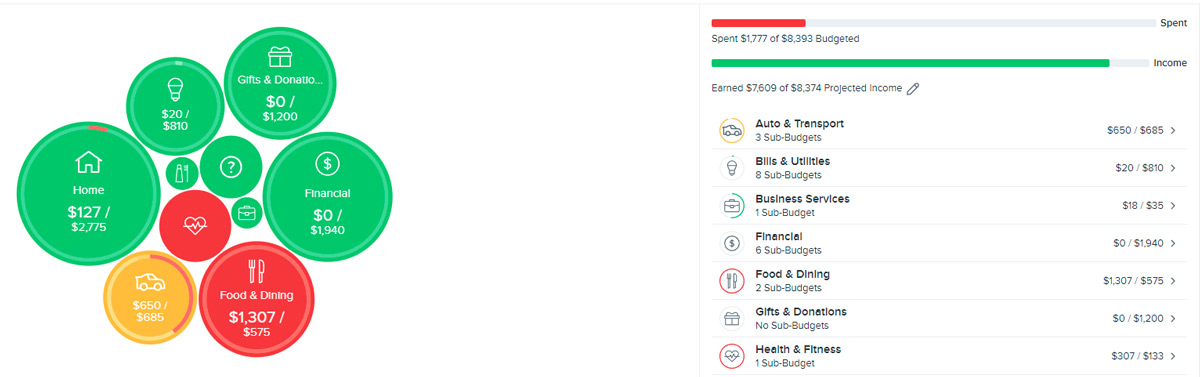

When Personal Finance has had a couple of months of spending to look at, it can help get you started on the next step—allocating a percentage or amount of money for each category each month. The budgeting tool can look at your spending history and auto-generate budgets for you based on your average monthly spending. As with any digital tool, think of this as a good jumping-off point. You should take a moment to verify that each budget portion feels correct. If not, you can adjust them by clicking on the budget bubbles and adjusting amounts.

The bubble budget view will help you see how large a portion of your overall spending each budget is and gives you an easy way to see how you’re doing in each category—green means you’ve spent less than 80% of the month’s budget, yellow means you’re between 80%-100% of your allowance, and red means you’ve exceeded the budget for that category. You can even set up alerts to help you stay on top of your spending as you go.

Review Your Budget

After creating your budget, make sure to review and adjust it periodically. You may realize that you are spending too much on entertainment, or that you need to set aside more money for unexpected expenses like car repairs. Just tap on the category bubble to edit the amount or add a sub-category. And remember to adjust for bigger things you are planning— for example, if you’re going on vacation in June, you might want to increase your transportation and entertainment budgets and lower your grocery budget for that month since you’ll be dining out more. The key is to have a plan but be flexible and tweak your budget as necessary.

Budgeting is a critical skill for managing your money, and Personal Finance can help make it easier to ensure that you have the funds for everything you need and hopefully, some things you want. Remember, budgeting is a process—it takes time to get it right, but if you stick with it, you’ll soon see the benefits of having a solid financial plan.