YEAR IN REVIEW - 2022

Year-in-Review: 2022 Market Summary

FOLLOWING THREE CONSECUTIVE YEARS of very strong returns for the S&P 500 (+28.9%, +16.3%, and +26.9%), the law of averages caught up with the markets in 2022. Through October 2022, the trailing 12-month return of -14.6% was in the bottom 5% of rolling 12-month returns since 1976. Volatility and market corrections are a regular part of stock investing so, while unwelcome, they are not completely unexpected. What made 2022 unusual from an investment standpoint was the historically poor performance of fixed income investments. The Bloomberg Barclays aggregate bond index had a year-to date return of -15.7% through October, putting 2022 on pace to be the worst year for bond returns … ever.

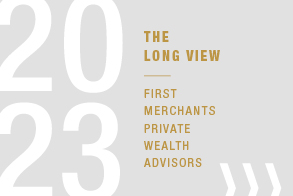

The speed and magnitude of the decline in bond prices caught many investors off guard. Typically used as a store of value and a hedge against stock market declines, bonds rarely experience double-digit declines over short periods of time. This double whammy of negative returns in both equity and fixed income investments in the same year made 2022 particularly unpleasant for investors of all risk appetites. The classic “60/40” balanced portfolio of 60% stocks and 40% bonds is poised to finish the year with a double-digit negative return for only the sixth time in the last 95 years. If the return of -15.7% through october does not improve by year end, it will be the worst year for the strategy since 1937.

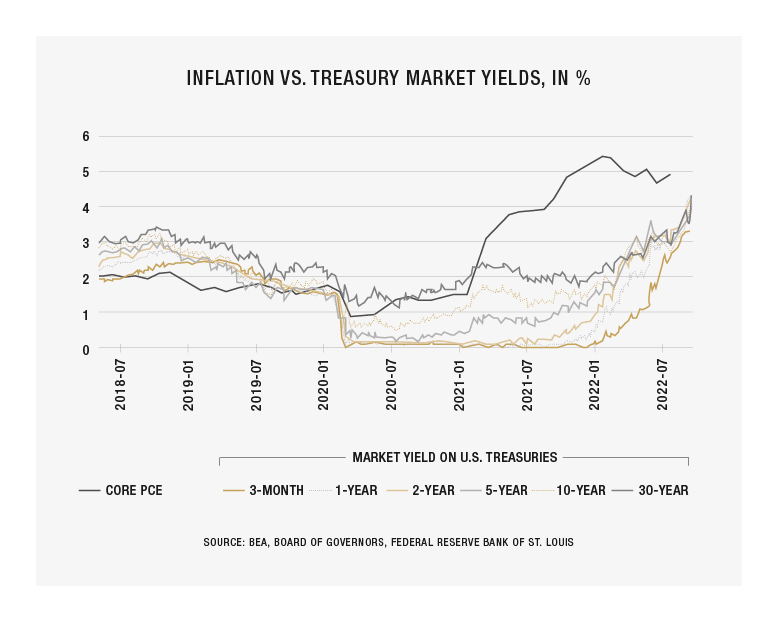

Most of the finger pointing for the poor market performance is aimed at the Federal Reserve. After implementing ultra-easy monetary policy through quantitative easing and pandemic-related stimulus, the Fed fueled the rise in inflation that it insisted would be “transitory.” When it became apparent in late 2021 that inflation was here to stay, the Fed began a rate hike cycle that has so far been the most aggressive since Paul Volker led the Fed from 1979 to 1987. With inflation figures climbing above 8%, the highest levels in 40 years, the Fed aggressively raised the federal funds rate from 0% to begin 2022 to 3.75% as of this writing.

The aggressive rate hikes can explain much of the poor performance in the bond markets in 2022. Since bond prices have an inverse relationship to interest rates, rising rates caused bond prices to fall. The long-running bull market in bonds, fueled by 40 years of falling interest rates, ended in a spectacular way in 2022.

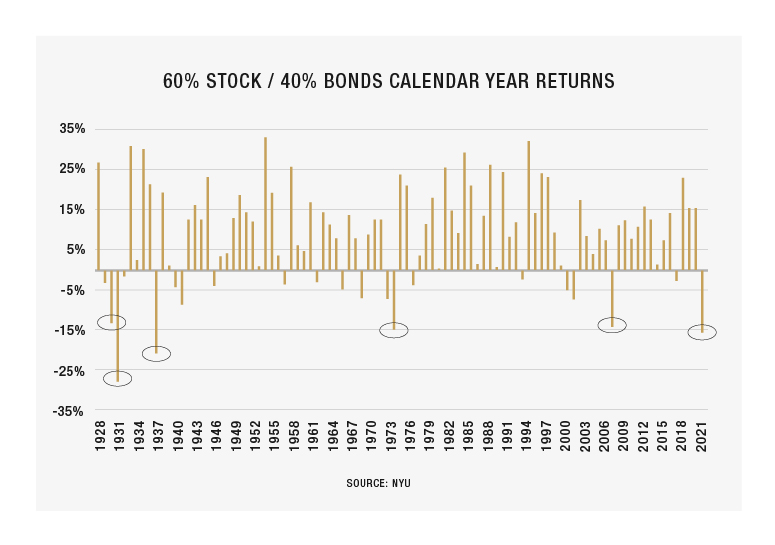

The rapid rate hikes also caused an inverted bond yield curve for much of the year. As the Fed continued to push the federal funds rate higher, short-term Treasury rates responded by climbing above 4%, their highest level in 15 years. Longer term bonds rose as well, although tempered by the expectation that the Fed’s rate hikes would prove too aggressive and cause the need for rate cuts in the future. The 10-year Treasury yield also crossed the 4% threshold, last reaching that level in 2010. If there is a bright side to higher rates, it is that there is finally a reasonable return to be earned going forward on fixed rate investments, something we haven’t seen in the past five years.

Higher rates can also take some of the blame for poor equity market performance, as the rising cost of capital for businesses reins in spending and makes debt financing more costly. For those looking for some clarity on when the rate hike cycle might end, Fed Chairman Jerome Powell has stated: “You want to be at a place where real rates are positive across the entire yield curve.” In order to have positive real rates, Treasury bond yields will need to rise above the level of inflation, or inflation needs to fall below the level of Treasury yields. As you can see in the chart above, the gap is closing, but real rates are not positive just yet.

Although the first two quarters of 2022 posted negative GDP growth, employment remained strong, leaving the determination of whether the economy entered a recession in the hands of a committee at the National Bureau of Economic Research. A host of factors contributed to the slowing economy during the year. The Russia/ Ukraine conflict continues to be a major contributor to food and energy supply issues. Ukraine, known as the “breadbasket of Europe,” is among the top three exporters of grain in the world. Russia is the world’s largest exporter of oil to global markets and the largest supplier of crude oil to Europe. Supply chain issues have continued to plague many industries, with the semiconductor industry among the most notable. Until recently, China’s “zero-COVID” policy had taken a toll on manufacturing in that nation as widespread lockdowns and quarantine measures were implemented at the first sign of new COVID cases. These measures inevitably lead to worker shortages and delays in manufacturing and shipping, creating a domino effect. Labor markets are reacting to the slowing economy as well, with layoff announcements increasing toward the end of the year, particularly among technology companies.

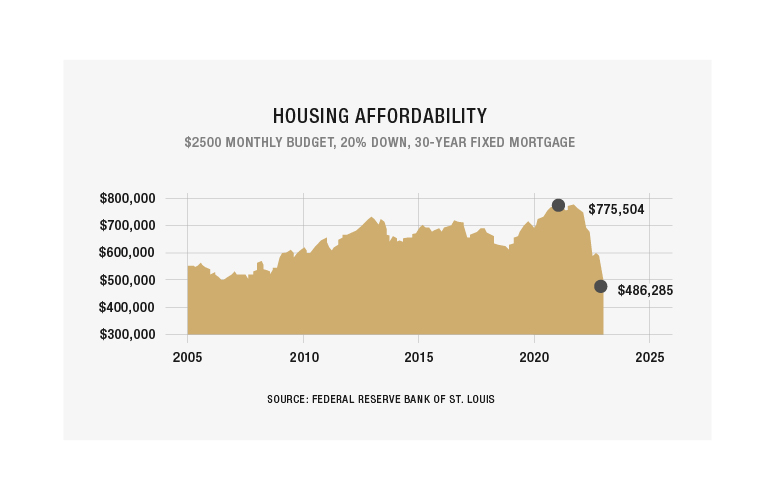

A renewed focus on cost measures has many corporations looking at reducing headcounts to maintain profitability. The housing market is feeling the slowdown as well. With mortgage rates rising past 7%, their highest levels since 2008, the demand for new mortgages and mortgage refinancing has collapsed. With one of the most rapid rises in mortgage rates in history, housing affordability has experienced a massive decline. The chart below shows the dramatic difference in the price a homebuyer can afford at today’s 30-year mortgage rates versus the rates one year ago, given the same monthly budget and 20% down. The decline in affordability is pricing many first-time homebuyers out of the market.

The year was full of challenges, many of which will carry forward into the year ahead. Perhaps the most significant question remains whether the Fed will be able to engineer a soft landing by finding the terminal rate that quells inflation but doesn’t send the economy into recession. If history is a guide, the Fed is likely to overshoot on rates and tip the economy into recession, ushering in the next rate cut cycle. It’s important to remember both the stock and bond markets anticipate these moves, often months in advance, so the reactions when they do occur are often not what you might expect. Your team at First Merchants Private Wealth Advisors will be here, as always, to help make sense of it all.