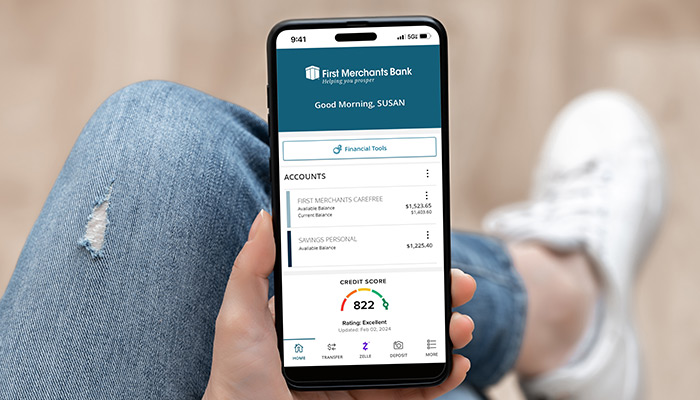

We've upgraded our online banking and mobile app to help you prosper – including making it easier than ever to manage your finances.

Jayden Pfleeger, Manager of Enterprise Application Services with First Merchants Bank, says the changes are designed to streamline personal finance and spending tracking while still providing the same robust service clients have come to rely on.

"For example, our Personal Finance Tool is now fully integrated into mobile and online banking," he shared. "It's the same tool, the same backbone – but the experience is completely different. Previously, you essentially had to open a new app to use it. Now, it's built right into your mobile banking app."

Built-in Budgeting

Customers enrolled in First Merchants' Financial Tools can easily toggle them "on" and immediately have all their transactions categorized by budget category.

"It's right in my transaction history – I don't have to go to another tab or page," Pfleeger said. "From there, I can easily recategorize any transaction if I need to."

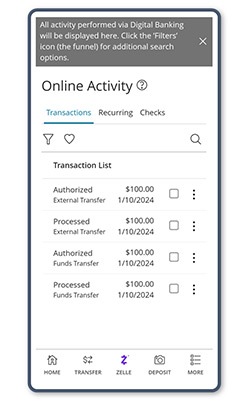

Easy-to-Read Transaction History

Easy-to-Read Transaction History

The Personal Finance Tool also "scrubs" transactions, presenting customers with the name of the store instead of a complex string of numbers or incomprehensible tags that show up on some transactions.

"So instead of a random name or a store number, it would just say the store's name," he explained. "For example, it would just say 'Walmart' instead of 'Store number 123' or 'Amazon' instead of 'AMZ' or what have you. It makes it much easier to track and confirm purchases when you go over your spending history, so you're not having to ask yourself, 'What was this again?' Or, 'Where did I send this money?'"

Big-Picture View

The budgeting and goal-setting tools are still the same, dependable ones clients know, but now they can pull in all their external accounts – right in the app.

"So those external accounts are displayed in the app right alongside your First Merchants accounts – whether they're checking accounts, investment accounts, retirement accounts, or debt accounts," Pfleeger said.

You can also group your accounts under custom categories, like "Shared," "Bills," or "Debt."

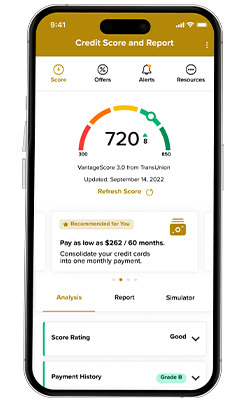

Credit Score At-A-Glance

Credit Score At-A-Glance

Worried about your credit score? You can now check it in your mobile app or online banking portal. First Merchants has partnered with SavvyMoney to bring a snapshot of your credit score so you never have to guess where you stand.

"It doesn't count as a pull on your credit, and it stays up-to-date," Pfleeger shared. "It's something that makes it much easier to monitor and improve your credit."

Card Swap

Suppose you lost your debit or credit card, opened a new bank account, or need to order a new card. In that case, it can be frustrating to update your payment information with payment apps or subscription services. Now, First Merchants customers can do that from within their app with Card Swap.

Just register your common payment sites and services with Card Swap, and when you need to change, Card Swap does all the work.

"Again, this can be done from within online banking or our mobile app," Pfleeger said. "So, you don't need to juggle numerous usernames and passwords or take a lot of time out of your day – it's all right there."

Other

Financial Tools

Other

Financial Tools

Other financial tools built into your new online and mobile banking experience include Stop Pay, which allows you to halt a payment, and the ability to change your direct deposit information.

"Now customers can change their direct deposit information – including amounts and bank accounts – from our app," Pfleeger said. "The only requirement is that the employer uses ADP. Though this feature can also be used with Federal payments like Veteran's Administration payments."

Overall, Pfleeger said these technological enhancements to the First Merchants mobile app and online banking platform make managing finances, saving, account security, and planning for the future more accessible than ever to our customers. It's just one more way we're helping you prosper.