Looking Forward, or Good Riddance

Explaining the excessive volatility in equity markets during 2018 is relatively straightforward. One, the Federal Reserve, in its quest to provide itself the means to contribute liquidity to markets and the economy should it be needed in the future, raised the Fed Funds rate four more times, from 1.50% to 2.50%. This on top of five raises of 0.25% each from December 2015 to December 2017. Two, the powerful earnings growth for US companies as a result of the 2018 Tax Cuts & Jobs Act will begin to wane in 2019, and equity markets finally woke up to this fact. The sum of the two, rising interest rates and slowing earnings growth, will always create instability in current equity prices.

We’ve written before that the current price of future cash flows (a bond’s periodic coupon payments, or the cash flows of a business) are set by a discount rate. This is the basis of the concept of “Present Value.” If that discount rate goes lower, you should be willing to pay more for a future set of cash flows; vice versa, if that rate goes higher, you should expect to pay less. The Federal Reserve relied on this mathematical fact, and the resultant “Wealth Effect” when it reduced the Fed Funds rate to 0.25% in the attempt to accelerate the growth of our economy. Whether or not it aided the economy, which averaged about a 2.00% growth rate, is open for debate. There can be little debate that equity prices were greatly impacted; the average annual return of the S&P 500 from 12/31/2008 (when the Fed reduced rates to 0.25%) through 12/31/2017 was 14.21%. Through 12/31/2018, after a rough year, the S&P 500 still generated a robust 13.32% total return. Those returns don’t describe a roller coaster ride, rather a rocket launch.

Let’s be optimists. The Fed wouldn’t raise interest rates unless they were positive the economy was in a strong enough position to withstand any fallout from doing so. We are coming off of three very solid prints for quarterly GDP and a December employment number far above estimates. As well, the revisions to previous month’s employment numbers were also quite positive. Wages are growing but not in an inflationary fashion; indeed, inflation is not currently an issue (and may not be for a long time). For reasons we’ll discuss in a minute, we highly doubt we are headed for a recession. Slowing growth, possibly. A recession, no.

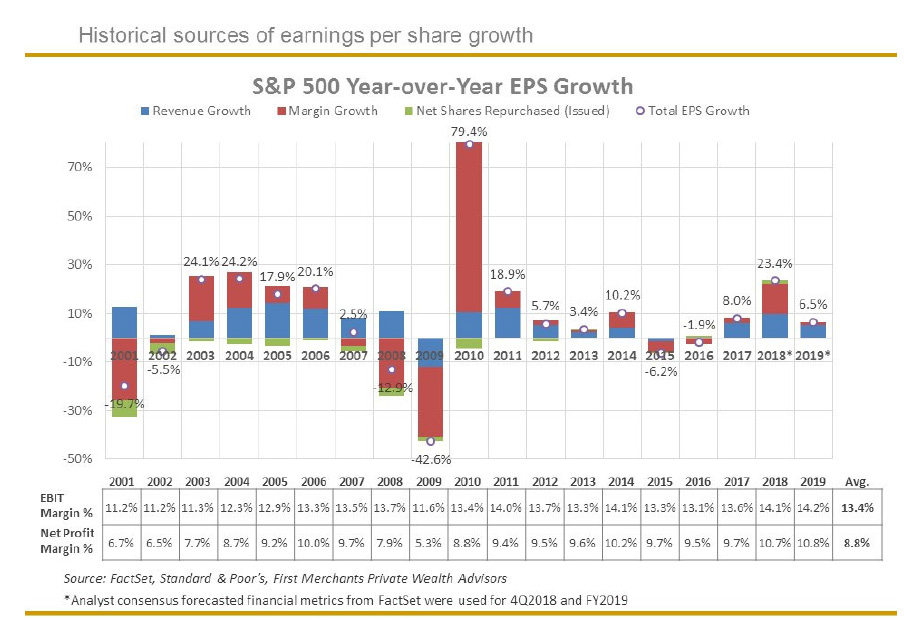

Though earnings for the S&P 500 for the four quarters in 2018 handily beat one year prior period earnings, the growth rate of earnings will slow for the first three quarters in 2019, when compared to 2018 earnings growth rates. That’s what’s stopped equity markets in their tracks. An optimist would note, however, those comparisons should again turn positive by Q4, and both revenues and earnings should grow closer to their longer term averages of 3-6% and 6-8% respectively. In other words, at some point in 2019, all else equal, we will have a much more fairly-valued equity market and revenue and earnings comparisons that will become easier to beat. We will also hopefully be back to a cessation of 1) a Federal Reserve artificially goosing equity prices by manipulating interest rates, and 2) equity markets where the cleverness and wherewithal of the individual company matters more than its tax rate. One thing that should be noted: Profit margins are relatively high according to historic averages. Their returning to longer term averages would weigh on corporate earnings growth as shown in the following graphic:

The pessimists should have their say as well. Housing statistics have been poor for several months now, and we note slowdowns, or rollovers, in real-time indicators such as packaging prices, freight rates, restaurant foot traffic, air travel, and lodging revenues-per-available-room. Vail Resorts Friday announced worsening earnings due to very poor bookings thus far, even though there has been a lot of snow. Globally, the production statistics from Germany are poor enough that many believe they may now be in a recession. China has also registered slower industrial growth. Like many others, we have concerns about the accuracy of those numbers, but note that China is Germany’s 5th largest export partner, based on 2016 statistics, and may be growing much more slowly than advertised based on Germany’s poor showing recently.

Be that as it may, we don’t believe a recession is around the corner. As noted in prior communications, a recession typically is the result of an economy growing faster, for several quarters, than its capacity to grow (the non-inflationary GDP growth rate can be closely estimated by adding the percentage increase in people entering the workforce to the percentage increase in productivity). Due to the general lack of inflation, low interest rates, overcapacity in many industries, and the demographics of aging, supply and demand for goods and services appear to be reasonably balanced in the U.S. between a GDP growth rate of 2% and 3%. The aforementioned “Wealth Effect” premises that people tend to spend not only some portion of their paychecks, but also some proportion of their increase in total wealth. In other words, if you watched your 401(k) grow by 14.21% per year from 12/31/2008 through 12/31/2017, you would also be inclined to spend more of your paycheck due to the increase in your total wealth. This is exactly what the Fed was after by reducing interest rates so drastically, though there was notable collateral damage, such as the tremendous increase in leverage in corporate America. But the Wealth Effect also works in reverse. Think about 2008, when you came home from work and checked out your investment portfolio. More than likely a lot of vacations were put on the back burner. There is every possibility that some of the slowing retail numbers were due to excessive volatility in October and December.

We reduced our client’s equity positions back to neutral four months ago, from a slight overweighting, have raised our cash positions in many accounts, and also slightly increased our short term bond positions. Bonds have performed exactly as they should; when we announced our tactical change the 2-year Treasury was yielding 2.84%. Today it was 2.54%, a fairly significant rally. As well, money market funds are now yielding more than the 2-year Treasury. The Fed has finally provided a reasonable place to hide if need be.

Though we are comfortable sticking with our slightly reduced risk positions, we would also note we pride ourselves on the timeliness and thoroughness of our monthly portfolio manager’s meetings and bi-weekly teleconferences. If we felt we had to act to further reduce risk on behalf of our clients, we would do so, as well as relay our thoughts and reasoning.

Thank you for being a client, it is always appreciated. The team that has been assembled here is, I believe, second to none. As always we welcome your comments and are always available for consultation. Best regards…

Jamie D. Wright,

CFA Portfolio Manager/Research Director

First Merchants Private Wealth Advisors

First Merchants Private Wealth Advisors products are not FDIC insured, are not deposits of First Merchants Bank, are not guaranteed by any federal government agency, and may lose value. Investments are not guaranteed by First Merchants Bank and are not insured by any government agency. This material has been prepared solely for informational purposes. First Merchants shall not be liable for any errors or delays in the data or information, or for any actions taken in reliance thereon. Any views or opinions in this message are solely those of the author and do not necessarily represent those of the organization.