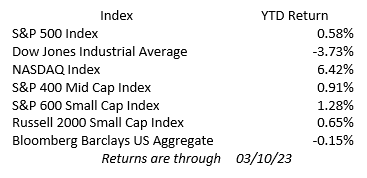

News of bank failures at Silicon Valley Bank (SVB) last Friday (and Signature Bank over the weekend) weighed on stock markets. For the week the S&P 500 tumbled 4.55%, the Dow Jones Industrial Average lost 4.44% and the Nasdaq was down 4.71%. Small-Caps and Mid-Caps also lost for the week with declines of 7.67% and 7.56%, respectively. However, all these stock indexes, except for the Dow Jones Industrial Average, remain in positive territory year to date.

The collapse of SVB was due to a unique set of circumstances. In recent years, the bank had grown deposits by over 230% primarily from clients in the startup and high-tech sectors. A large proportion of those deposits (roughly 90% at the end of 2022) exceeded the FDIC’s deposit insurance limit, adding further risk to the concentrated deposit base. In turn, a significant amount of those deposits was invested in U.S. Treasuries and other bonds at or near record low yields. When the venture capital and high-tech sectors came under funding pressure last year, they had significant withdrawals from SVB, which forced the bank to sell securities at a significant loss, leaving SVB undercapitalized. When they failed to raise fresh capital, regulators intervened and seized the bank on Friday. Signature Bank had a similar set of circumstances, with a heavy concentration on cryptocurrency clients.

On Sunday, authorities introduced two significant interventions designed to reassure the financial system. First, the FDIC indicated it would guarantee all depositors in SVB and Signature Bank, not just deposits under $250,000. This will allow depositors to access their funds immediately. The second intervention was the introduction of a new lending facility by the Fed. This new lending facility will allow banks to borrow capital for up to one year. More importantly, the collateral (bonds) will be valued at 100 cents on the dollar, even for bonds trading at significant discounts, thereby allowing banks to avoid realizing bond portfolio losses to meet liquidity needs.

Although there is continued stress in the market, particularly in the financial sector, it should be noted that the U.S. banking system is much better capitalized than prior to the global financial crisis. The silver lining in this latest bout of volatility is that U.S. Treasury yields have declined significantly and expectations of the Fed’s tightening policy have moderated. This is helping bond investors, including banks, as bond prices have bounced sharply.

On the economic front, Nonfarm payrolls rose 311k in February, 96k higher than expected, but not as much of an upside surprise as the previous month. January and December payroll numbers were both revised down slightly. Average hourly earnings were up 0.2%, just under expectations of 0.3% for the month. The year-on-year number shows average hourly earnings up 4.6% from 4.4% in January. The unemployment rate went up from 3.4% to 3.6%.

This week’s economic calendar is packed. Today the CPI (Consumer Price Index) reports for February. The core CPI, ex-Food and Energy, is expected to be unchanged from the previous month, while the year-over-year numbers are expected to be down just a bit. Wednesday brings the PPI (Producer Price Index) and Retail Sales. Thursday, the housing starts report comes out and is expected to show a positive 0.50%, up nicely from the negative 4.5% in January. Friday closes the week with reports on industrial and manufacturing production.