Preparing to take out a mortgage is a big decision. Using a mortgage calculator can help to estimate your monthly mortgage payments and start planning for your financial future.

Our mortgage payment calculator breaks down your monthly payments by reviewing your home’s purchase price, the down payment, property tax, homeowner’s association dues and home insurance. You can also use our calculator to review how your mortgage payments will change based on your loan term and interest rate.

This article will identify and explain the elements that make up a monthly mortgage payment, the formula used for calculating payments, and the benefits of using a mortgage calculator including determining affordability, experimenting with repayment structures, and amortization.

What's included in your monthly mortgage payment?

A mortgage payment is not just the cost of repaying the amount borrowed. The amount of taxes, interest charges and other factors that are included in each monthly payment can surprise new applicants. Before using a mortgage calculator, it is important to understand what these key elements are:

Principal

The principal is the amount that has been borrowed for a home loan. This element does not include any charges or interest and only covers the amount that needs to be paid back across the term of the loan.

Interest

The interest charged on mortgage repayments will be determined by the lender based on the base rate, which accounts for economic shifts in the national and international markets that you cannot personally control. The base rate figure is then adjusted depending on your perceived level of risk. Factors like a strong credit score and a larger down payment will make you more attractive to lenders and make you more likely to be offered lower interest rates.

Using the base rate as a benchmark will provide a good indicator of what kind of rates are typical at the time of your application, but your lender may have a selection of loan programs that could be lower or include a fixed rate, protecting you from fluctuations in cost for the duration of the agreement.

Interest is calculated annually against the remainder of the principal left to repay. Making additional payments when possible can help to reduce the total left to pay, which will help to reduce the amount of interest payable in the next 12 months.

Property taxes

All property owners in the US are required to pay property tax, a local government tax based on the value of a property and its land. This is calculated annually but is usually paid monthly as it is common for it to be included as part of monthly mortgage payments.

To determine your estimated annual property tax, simply multiply your home’s assessed value by your local government tax rate.

Home insurance

Homeowners insurance is a requirement from all mortgage lenders to protect their investment should anything happen to the house. If you have an escrow account, the insurance premium will be split into monthly payments and taken alongside the mortgage. If the insurance is paid separately, then the homeowner can arrange to pay the insurance in another way, such as quarterly or annually.

HOA Fees

Homeowners Association (HOA) fees will depend on the location and type of property being purchased. These fees are related to the upkeep of community spaces, such as grass areas or shared amenities.

These fees are typically charged either monthly or yearly and it is often possible for prospective buyers to see how much the current owner is paying.

What Is the formula for calculating mortgage?

Our mortgage payment calculator provides estimates based on fixed-rate mortgages, but for those looking for a more precise estimate based on adjustable-rate mortgages, check out our ARM calculator.

If you prefer to calculate your monthly payments manually, the following formula is commonly used:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

M = monthly mortgage payment

P = the principal amount (the opening balance of the loan)

i = your monthly interest rate

n = the number of payments over the life of the loan.

How to use a mortgage calculator

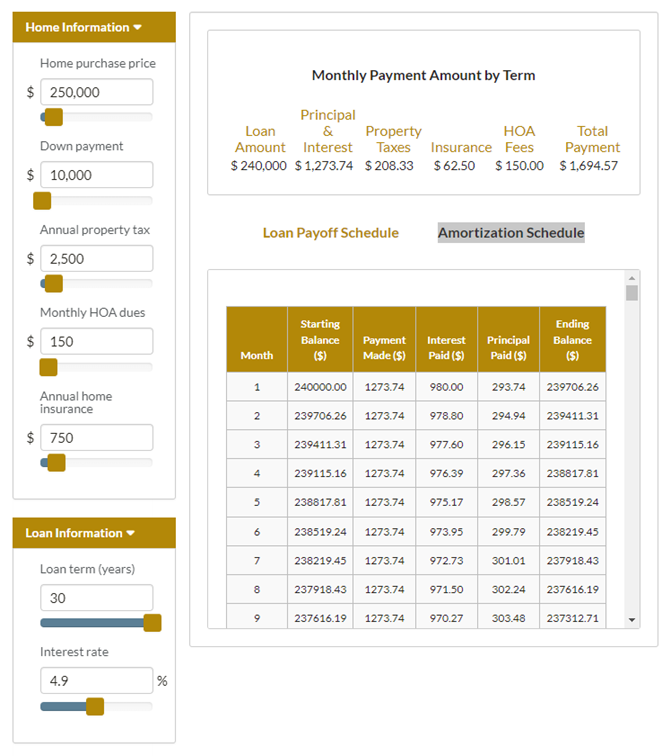

To start using our mortgage calculator, simply complete the sections in the left-hand side columns “Home Information” and “Loan Information” as accurately as possible.

- Home purchase price (Principal)

- Down payment

- Annual property tax

- Monthly HOA dues

- Annual home insurance

- Loan term (years)

- Interest rate

Once these sections are completed, the top row of the calculator will show your monthly payment amounts by term. This is broken down so you can see both the total and the different elements that make up the final monthly payment.

The final section of the calculator is the area which will display either a ‘Loan Payoff Schedule’ graph or an ‘Amortization Schedule’ table showing annual payment progress and the split between interest and principal payments made each year.

First Merchants has a range of mortgage calculators to help you decide whether to rent, refinance or compare loans. Find these tools on our Mortgage calculators page.

Should I use a mortgage calculator?

Using a mortgage calculator is an important first step in your homeowner's journey as it will help you to understand what is affordable and account for additional and unexpected costs that are required of homeowners.

Lenders will perform detailed financial checks when reviewing an application, requiring a large amount of personal information. Mortgage calculators do not have access to this level of detail and are not perfect, but they are a valuable method for benchmarking your situation and have many other benefits. Here are just some of the reasons you should use a mortgage calculator:

Determine if the house is affordable

You have a home in your sights, but how does the asking price equate to monthly payments? Using a mortgage calculator can give you a quick indication of how much the mortgage will cost. This figure is likely to be the largest regular payment you will have to make, so making sure it aligns with your budget before applying is crucial.

Review loan terms

The loan term (number of monthly payments) will not just determine how long you have to make repayments, but also the amount of interest that will be paid. A shorter term will cost more per month and collect less interest, but a longer term will have more affordable regular payments but take longer to pay off and the final total will be higher, due to additional interest.

The most common mortgage loan term is 30 years, but the majority of people will not stay in a property for this long. Over their lifetime, the average American will own three different houses.

Set a down payment amount

Using a mortgage calculator can help to find a balance when trying to set down payment and monthly payment rates that are affordable and beneficial.

Many loan types will have a minimum requirement for down payments, but it can be beneficial to make a higher payment where possible as this will help to reduce the cost of monthly payments.

Many loan programs will also require Private Mortgage Insurance (PMI) with a down payment of less than 20%. PMI will increase your monthly mortgage payment, so it’s important to speak with a lender about what programs are right for you.

View an amortization schedule

Mortgage calculators will often show an amortization schedule, a breakdown of each monthly payment to identify how much is going towards interest and how much is paying off the principal loan.

By reviewing the amortization schedule, you will be able to see the impact that increasing monthly payments or making a larger down payment could have on the amount of interest you have to pay or the number of payments you will need to make.

The next step towards home ownership

The most important consideration when beginning the homebuying journey is determining affordability and budgets. Using a calculator is a fast way to get a sense of the monthly costs involved in purchasing, allowing you to set budgets and limits when looking for properties and ensure your monthly payments are as affordable as possible.

After using our mortgage calculator, we recommend using our mortgage pre-approval program before you start seriously hunting for a home. This process will verify how much mortgage you can afford and will also signal to realtors and sellers that you’re a serious buyer. It can also help you determine what type of mortgage you can afford, when considering down payments and monthly payments.

For more tips and advice check out our article ‘Five Ways to Financially Prepare for Your Big Move’.

How First Merchants can help?

Now that you have an idea of your mortgage payments, it’s time to speak to the experts. Just give us a call at 1.800.205.3464. Our Customer Service team is available weekdays from 8 a.m. until 8 p.m. ET, and from 9 a.m. until 3 p.m. ET on Saturdays.