Who doesn’t like getting a bonus? It’s safe to say—the bigger, the better. But when it comes to how bonus compensation is treated within an employer-sponsored retirement plan, it’s important to understand your requirements when applying employee deferral rates.

Most plan documents define 401(k) compensation as amounts reportable on Form W-2, which typically includes bonuses. At some point during the plan setup, these specifics were chosen by the Plan Sponsor along with eligibility, entry dates, and vesting to name a few.

To be fair, it may have been years since the plan was established, and the number of details can be overwhelming. If there’s been staff turnover, important information might not have been passed along. Still, it’s vital that the plan is administered according to its terms—doing otherwise could jeopardize the plan’s qualified status and lead to costly penalties and corrections.

Let’s break it down:

If bonuses are excluded from eligible compensation, they may not be deferred upon. Do not defer—ever.

If bonuses are included in eligible compensation, you’ll need to determine how deferrals should be handled. Typically, one of two approaches will apply:

- Bonuses are treated the same as regular wages: No flexibility here. If an employee is deferring 3% pretax, then 3% pretax must be taken from their bonus. Employer matching may also apply. Remember: consistency is required across regular pay and bonuses.

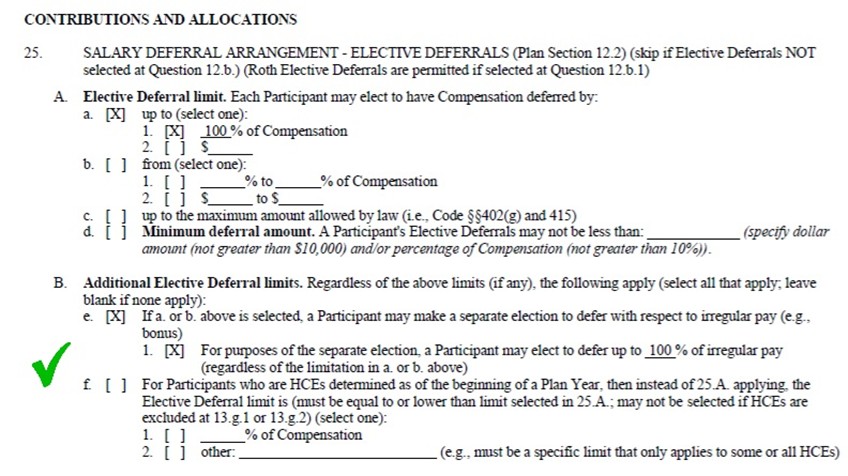

- Bonuses may be treated differently than regular wages: Here, there’s flexibility. For example, an employee might defer 3% pretax on regular wages and 6% on bonuses—or none at all. Bonuses are often considered “irregular pay,” and many enrollment forms or participant websites allow employees to make this distinction. If no distinction is made, the standard deferral rate applies to both. Documentation is key.

We've seen a rise in administrative missteps around this issue. “I didn’t know” is a common refrain. If your current plan structure doesn’t align with your goals or procedures, consider amending it to help avoid compliance headaches down the road.

First Merchants Private Wealth Advisors products are not FDIC insured, are not deposits of First Merchants Bank, are not guaranteed by any federal government agency, and may lose value. Investments are not guaranteed by First Merchants Bank and are not insured by any government agency. This material has been prepared solely for informational purposes. First Merchants shall not be liable for any errors or delays in the data or information, or for any actions taken in reliance thereon. Any views or opinions in this message are solely those of the author and do not necessarily represent those of the organization.