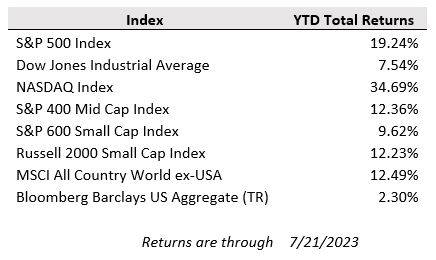

US equity market performance continued to broaden out last week as high-flying technology stocks pulled back from their year-to-date surge, while this year’s worst performing sectors—including utilities, healthcare, financials, and energy—all notched healthy gains. Technology stocks were weighed down by earnings reports that fell short of lofty expectations, including those from giants like Tesla and Netflix. Additionally, big tech stocks sold off ahead of a special rebalance of the Nasdaq 100 index that occurred early this week to reduce the concentration of the top holdings as the top 10 stocks approached a whopping 60% weighting in the index. The Dow Jones index, which has posted its longest consecutive daily stretch of gains after rising ten days in a row, gained 2.1% last week, while the S&P 500 eked out a 0.6% gain and the tech-heavy Nasdaq Composite fell 0.6%.

The improving market breadth reflects rising investor confidence in the potential for a “soft landing” for the U.S. economy in which higher interest rates will continue to bring down inflation without causing a recession. The rising sentiment is also echoed by Wall Street and corporate executives, according to John Gray, the president of the world’s largest alternative asset manager, Blackstone, who stated expectations for a near-term pick-up of corporate merger & acquisition activity in a recent interview with the Financial Times.

Rate sensitive areas of the economy have certainly cooled off this year but have remained more resilient than many economists anticipated. Last week’s report of a 3.3% drop in existing home sales in June was disappointing, but not surprising, as a lack of supply is limiting sales. Homeowners are reluctant to sell because selling means giving up low mortgage rates. Mortgage prepayments are so low, the average rate paid by US homeowners is just 3.5%, despite a current prevailing rate near 7%.

Market sentiment will be tested this week as investors brace for several significant central bank policy meetings around the world. The Federal Reserve will be first up with a press conference on Wednesday to announce the central bank’s updated monetary policy stance. After pausing rate rises last month, the Fed is expected to raise borrowing costs by 0.25%, its 11th increase since March of last year. Futures markets are pricing in just a one-in-three chance of a rate increase in September at the Fed’s next meeting. Economists also increasingly see the Fed’s tightening cycle coming to an end this week.

The European Central Bank then meets on Thursday. Economists expect the ECB will also raise rates by a quarter of a percentage point. Beyond that, the outlook is less clear. Inflation has begun to fall in the eurozone. Whether that’s enough to persuade the bank’s president, Christine Lagarde, and her colleagues to pause (or stop) after this week, is less certain.

On Friday, the Bank of Japan decides. Data released last week showed headline inflation outpacing the United States for the first time in years. But economists expect the central bank to stand pat, largely because wage growth in Japan is relatively subdued. Global investors, including Warren Buffett, have flocked to relatively cheap Japanese stocks this year, enticed by the country’s economic outlook.

In other news this week, big tech will be part of a parade of 165 S&P 500 firms set to report quarterly results. Investors will be tuning into the earnings calls for Microsoft and Alphabet — both on Tuesday — and Meta on Wednesday for clues on whether the explosion in interest around artificial intelligence is affecting their business outlooks.