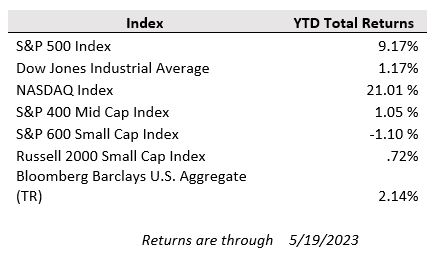

U.S. equities were higher last week, with the S&P 500 positive for the first time in three weeks and breaking its six-week streak of changes of less than 1% as the index gained 1.7%. Meanwhile, the Nasdaq was higher for a fourth-straight week with a 3.1% surge last week. The Nasdaq’s strong year-to-date outperformance (up over 21% so far in 2023) is driven by its significant concentration to large technology stocks that have soared this year after last year’s brutal sell-off with a lift from cooling inflation and interest rate expectations and optimism around artificial intelligence. Treasuries saw a big selloff across the curve, with the 2Y back near 4.30% and at the highest level since mid-March.

Markets largely continue to mark time under the cloud of debt ceiling talks. The current standoff over the debt ceiling has the potential to put more strain on the U.S. economy, which is already vulnerable to a recession after a series of interest-rate hikes by the Federal Reserve, according to Bloomberg Economics. A U.S. default would risk triggering a market selloff, substantially increase borrowing costs, (already up 33% year-over-year due to higher interest rates) and become a potential hit to the global economy.

However, the likelihood of a default on U.S. government debt remains very low, even in the event that there is no compromise before the so-called x-date (the date the Treasury runs out of funds), as government officials are more likely to pursue other alternatives before the drastic measure of missing a debt payment. These alternatives include a short-term extension with a small debt ceiling increase or limited-term suspension to allow more time for negotiations, or the Treasury prioritizing spending by temporarily halting payment of other budget items to avoid default. This ladder alternative would have its own set of negative ramifications, but they would pale in comparison to the economic damage of a default.

On the economic front, the latest round of consumer data shows that spending remains resilient, but inflation is taking a bite. Retail sales—a measure of spending at stores, online and in restaurants—rose a seasonally adjusted 0.4% last month compared with March, up from a revised 0.7% decline in March, the Commerce Department said. Last month’s increase in sales was the first since January. Consumers spent more at auto dealerships, home-improvement stores, bars and restaurants and online. They cut spending at gasoline stations and at stores selling sporting goods, musical instruments and books.

Retail sales increased 1.6% in April from a year earlier, the Commerce Department said. The year-over-year increase was below the 4.9% inflation rate for the same period. In other words, although sales growth remains positive, most of that growth is coming from price increases rather than a growing volume of goods and services being consumed. The data add to a mixed picture of economic activity. U.S. growth cooled in the first quarter and home prices fell in more parts of the country than they have in over a decade. But a solid labor market last month kept wage growth elevated while inflation cooled to its slowest pace in two years. Tepid retail sales come as the Federal Reserve increased interest rates to fight inflation by slowing the economy. Fed officials earlier this month raised short-term interest rates for the 10th consecutive time, bringing the benchmark federal-funds rate to a 16-year high.

This week, the markets will be digesting the following economic data: PMI Composite (51.7 estimate), PPI (0.3% estimate), GDP year over year (1.6% estimate), and the Fed’s preferred gauge of inflation, Personal Consumption Expenditures.