According to The Stock Trader’s Almanac, February is historically the second-worst month for the markets. The recent pullback has not been unexpected, especially on the heels of the recent rally in the markets. 2023 is a pre-election year, the best year of the 4-year cycle for the market as incumbent presidents prime the pump and do everything in their power to get reelected. This suggests a potential positive year of the market, even considering the recent decline.

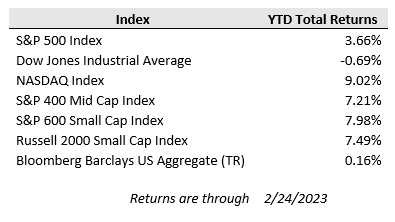

The major market averages finished lower for the week, with the Nasdaq Composite falling 3.3%, while the S&P 500 lost 2.7% and the Dow Jones average ended down 3.0%.

The Personal Consumption Expenditures (PCE) price index — the Fed's preferred assessment of how quickly prices are rising across the economy — rose 0.6% in January and 5.4% from last year. Core PCE, which strips out volatile food and energy components, prices rose 0.6% for the month and 4.7% from last year. The report from the Commerce Department also showed that consumer spending rose 1.8% last month from December after falling the previous month. The numbers support recent indications inflation is not falling at the pace and extent investors have been hoping for, even as prices have stabilized from the peaks of the current inflation cycle.

Gross domestic product (GDP) increased at an annual rate of 2.7% in the fourth quarter of 2022, according to the second estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.2%. The increase in real GDP in the fourth quarter reflected increases in private inventory investment, consumer spending, nonresidential fixed investment, federal government spending, and state and local government spending that were partly offset by decreases in residential fixed investment and exports. Imports also decreased.

Personal income rose 0.6% in January, a solid gain fueled by wage and salary growth and by more than a half million new jobs.

With Q1 2023 earnings season almost over, it appears net profit margins for S&P 500 firms will be in the 11.3% range, according to FactSet . While this would be the sixth straight quarterly decline, and well down from their Q2 2021 13% peak, it returns profits to where they were in 2019. Lower profits could lead to reduced corporate investment, lower investor payouts, and layoffs.

On the geo-political front, Russian President Vladimir Putin said Moscow would step back from the last remaining major nuclear-arms-control treaty between the U.S. and Russia. Mr. Putin’s move, announced Tuesday, came hours before President Biden again sought to rally international support for Ukraine in Poland ahead of the first-year anniversary of the invasion, and a day after traveling to Kyiv to meet with Ukrainian President Zelensky. (Wall Street Journal)