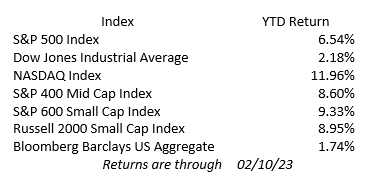

Last week the markets gave back just a little bit of the year-to-date gains. For the week ending 2/11/23, the S&P 500 was down 1.07%, the Dow Jones was down 0.11% and the NASDAQ was down 2.37%. The S&P 400 Mid-Cap was down 2.49% and the S&P Small-Cap 600 was down 3.44%. Even the Bloomberg US Aggregate Bond Index was down 1.43%. Investors are still working to get a better sense for how high the Fed will raise rates and how long rates will stay at those elevated levels.

Markets continue to be impacted by the previous week’s Fed decisions and remarks and the strong jobs report. While a strong jobs report is encouraging news with regard to the outlook for continued resilience in consumer spending, it can be bad news for Fed policy. The central bank may look to push rates higher for longer than the market expects to rein in wage inflation from the overheating labor market. The University of Michigan Sentiment Index showed that consumer sentiment came in higher than expected at 66.4 for February. This signals that US consumers are more positive than they have been in more than a year, even with lingering challenges in the economy.

Corporate earnings season continued last week. Disney (DIS) beat expectations as well as released plans for restructuring and looking to reinstate a dividend by year end. All taken positively by shareholders. Pepsi (PEP) also reported with a nice beat of expectations in revenue and an announced increase of 10% to its annualized dividend. This represents the 51st year of consecutive annual dividend per share increases.

The Consumer Credit report for December showed credit rose just $11.6 billion, about half of the expected $25.2 billion. January consumer credit is expected to rebound. We see that while consumers pulled back in December, some of that was due to terrible weather the week of Christmas.

The President made his State of the Union Address last week. Some specific policy topics included a call for quadrupling the 1% tax on corporate share buybacks and increasing environmental spending. Neither of these topics will likely get much attention any time soon as Congress has a lot of other issues to focus on.

This week the economic calendar is very full. Today the Core (less food and energy) Consumer Price Index (CPI) is expected to come in a little lower year-over-year. Continuing its downward trajectory in response to the Fed increasing interest rates. Tomorrow we will hear about retail sales, industrial production, and manufacturing. Thursday brings us initial and continuing jobless claims along with housing starts. In addition, the Producer Price Index (PPI) comes out and is expected to be slightly higher than the previous month, but lower year-over-year. Earnings season continues with some notable names of Coca-Cola (KO), Cisco Systems (CSCO) and Deere (DE).

Please check out our First Merchants Private Wealth Advisors – The Long View 2023 for a short look back at 2022 and our assessment of 2023: The Long View 2023 Business Vision | First Merchants Bank. You can watch the YouTube video or download and read the entire “The Long View: 2023 Business Vision.”