Overdraft Protection

We are here to help you understand how overdrafts work and what options you have to avoid them.

We get it. Accidents happen. That purchase you made was a little more than you had in your checking account. This is an example of an overdraft – when you spend or withdraw more than you have in your account, and the transaction still goes through. Read on to learn about First Merchants Bank’s overdraft services and standard overdraft practices.

Our Standard Overdraft Practices:

First Merchants Overdraft Helper™

Overdraft Helper™ provides assistance when your account is overdrawn. Your account is overdrawn when there is not enough money in the account to pay for the purchase or transaction. We may pay overdraft transactions at our discretion based on your account history.

What does an overdraft cost? We charge a $37 overdraft fee per transaction that is paid once your balance is overdrawn above $50 (maximum of six fees per business day).

How does Overdraft Helper™ help avoid this fee?

- More flexibility: $0 overdraft fees if you’re overdrawn by $50 or less at the end of the business day.

- More time: $0 Recurring Overdraft fee until the fifth business day. Starting the fifth business day we will charge an $8 Recurring Overdraft fee per day the account is overdrawn at any amount.

First Merchants Overdraft Helper™ does not require enrollment and comes with most First Merchants Personal Checking Accounts.*

*Simple Access accounts do not permit overdrafts.

Link other accounts for backup*

Transfers from Linked Deposit Accounts:

Use another First Merchants account as a backup in case your checking account is overdrawn. We’ll automatically transfer funds from your linked account if you need them.

Transfers from Linked Line of Credit Accounts:

Use a First Merchants line of credit (unsecured) as an automatic backup to your checking account or easily link your account to a home equity line of credit. Subject to credit approval.

Contact your local banker or call customer service 1.800.205.3464 to link your accounts today!

*Overdraft Helper will not kick in if an account is set up for transfers from another account.

Use these tools to track your balance 24/7.

Download the First Merchants Mobile App and keep track of your balance.

Set up Account Alerts within Online Banking and be notified by text or email anytime your balance falls below a limit you can set.

Set up Debit Card Controls in the mobile app and be notified every time your card is used.

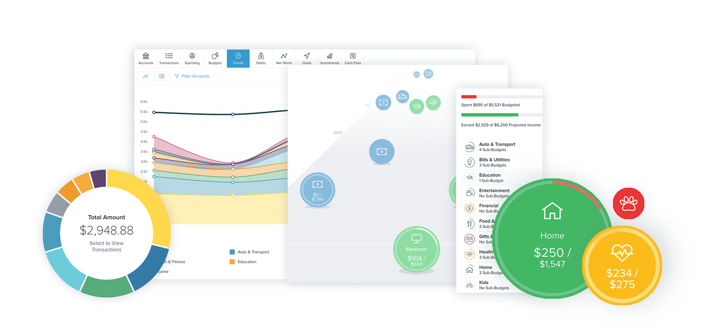

Manage Your Whole Financial Picture

Set up the First Merchants Personal Finance management tool in online banking and begin viewing all your financial accounts, even from other financial institutions...you name it, and Personal Finance can track it. You can even set spending budgets that may better prevent overdrafts.