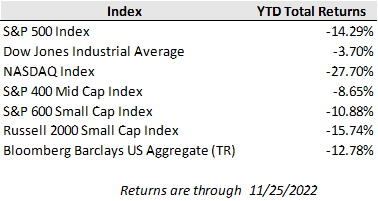

U.S. equity markets continued to push higher amid a quiet, holiday-shortened trading week as investors gauged Black Friday reports for indications of how U.S. consumer spending is holding up in an important holiday season. For the week, the Dow Jones gained 1.8%, bringing the index to just over 5% below its prior year-end mark (excluding dividends), while the S&P 500 and Nasdaq Composite returned 1.6% and 0.7%, respectively. The recent equity market rally has gotten some support from a break in the relentless push higher in interest rates as long-term rates slid lower last week with the U.S. 10-year Treasury yield closing at 3.69%, compared to 4.10% a month ago.

Early reports from the Black Friday shopping weekend point to strong trends in both in-store traffic and online shopping. Data from Sensormatic showed a 2.9% increase in foot traffic at retail locations on Friday compared to year ago and a nearly 20% increase on Thanksgiving itself. Meanwhile, Adobe Analytics reported record online Black Friday sales which grew 2.9% year-over-year. The strong sales data accompanies higher than usual promotional activity as retailers work to trim down bloated inventories. At this point, U.S. consumer spending remains resilient with labor market support and lingering stimulus savings, but trends in growing trade-down activity to cheaper goods and declining savings rates and bank deposits show building pressure on consumption looking out to next year.

Another important trend to watch is the recent tumble in oil prices with WTI crude oil now sitting at its lowest level since December of last year after falling over 36% from its June peak. Mounting concerns of slowing global economic growth have fed into the decline, and the recent rise in Covid concerns and policy response out of China have been a chief culprit pushing down oil prices over the last few weeks. In response to a retightening of Covid lockdowns to contain rising new cases (which have marked a new record reported 7-day average in China of over 27k), a series of protests broke out over the weekend in large cities across China including Wuhan, Shanghai, and Beijing.

In the week ahead, there is a full economic calendar including a highly anticipated November jobs report as well as updates on consumer confidence and third quarter GDP growth. The consensus economist forecast is for a 200k increase in payrolls for the month and for the unemployment rate to hold steady at 3.7%. Investors will be reviewing the report closely as it will be an important piece in setting rate hike expectations and terminal rate forecasts ahead of the next FOMC meeting.

The recent rally in stocks and bonds has provided some relief in a difficult year for investors. Financial markets seem to have the wind at their backs heading into year’s end as the holiday season tends to be a seasonally strong period for stocks and recent inflation data has trended in the right direction. However, though the market may now be cheering initial signs of easing pressures on inflation and interest rates, that may also be a prelude to weakening economic conditions and falling corporate earnings expectations. As the focus shifts to next year, a reset in 2023 earnings expectations may stir up further turbulence. The consensus S&P 500 earnings forecast for 2023 has gradually declined by 8% from the mid-year outlook, according to FactSet, but still anticipates greater than 5% earnings growth next year. Despite the short-term noise and uncertainty, we caution against overfocusing on and reacting to short-term trends, whether to the upside or the downside, and our team is always here to help you assess your long-term strategic financial plan and invest with that perspective in mind.