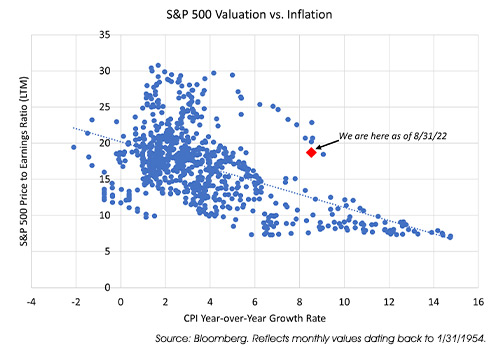

Let’s start with the obvious: the Federal Reserve is pressing the brakes. Hard. Economic growth is now cooling as intended, and equity market valuations are adjusting lower in response to higher interest rates. Underlying the tumultuous market volatility and daily headlines is the fact that breaking the back of inflation is a necessity for a healthy long-term investment outlook. Sustained high inflation has historically weighed heavily on asset valuations, as shown in the chart below, as interest rates are pushed higher, and investors require greater rates of return in the equity markets as well. The greater risk to the economy and financial markets is in doing too little and allowing sustained high inflation to fester and feed on itself. The Federal Reserve recognizes this and is determined to maintain credibility in its ability to restore price stability.

With that context, Jerome Powell didn’t pull any punches in his August 2022 Jackson Hole Symposium

remarks. The Fed chairman talked about using the Fed's tools forcefully. He also mentioned that a sustained period of lower growth and a softening labor market would likely be required to resolve the inflation problem. Lastly, the Fed Chair delivered

a powerful statement confirming that the central bank would “keep at it until the job is done,” even if this brings some short-term pain to households and businesses. The stock market reacted, retracing some of the ground it had made up

over the last few months since mid-June, as Powell’s direct comments diminished hopes for a soft-landing.

With that context, Jerome Powell didn’t pull any punches in his August 2022 Jackson Hole Symposium

remarks. The Fed chairman talked about using the Fed's tools forcefully. He also mentioned that a sustained period of lower growth and a softening labor market would likely be required to resolve the inflation problem. Lastly, the Fed Chair delivered

a powerful statement confirming that the central bank would “keep at it until the job is done,” even if this brings some short-term pain to households and businesses. The stock market reacted, retracing some of the ground it had made up

over the last few months since mid-June, as Powell’s direct comments diminished hopes for a soft-landing.

Following the pushback from Powell and other Federal Reserve members against the potential for a near-term policy pivot, rate hike expectations have reset to reflect the prospect of higher interest rates for longer. Fed funds futures now point to short-term rates hitting 3.75% to 4.0% by year end and remaining there until late 2023/early 2024 before easing lower. Treasury yields have lifted higher with the two-year Treasury yield at its highest point since 2007 at over 3.4%, and the curve is firmly inverted, indicating higher potential for an economic downturn. Based on the yield curve, the Federal Reserve Bank of Cleveland pegs the probability of recession over the next 12 months at 27% as of the end of August, and this may continue to tick higher as the Fed pushes up short-term rates.

When the talk of recession is on the rise, so too is the temptation among investors to stray from their long-term investment strategies and try to time the market – this is where the greatest investment mistakes are often made. The stock market is a forward discounting machine that will sniff out the top and the bottom in corporate earnings long before they occur. In fact, according to a study by Robert Schiller and Goldman Sachs, in U.S. bear markets dating back to 1903, the stock market has bottomed 6 to 9 months before earnings per share started to rise on average.

We would also note that while the prospects of economic growth are receding and that will have implications for corporate earnings, the stock market is not the economy. At the end of the second quarter, real GDP was up 2.5% compared to before the pandemic at the end of 2019. During the same period, the S&P 500 earnings per share were up 36%, according to FactSet. Despite recent downward revisions, forward looking, bottom-up earnings forecasts for the S&P 500 are expected to grow by 8.3% in 2023.

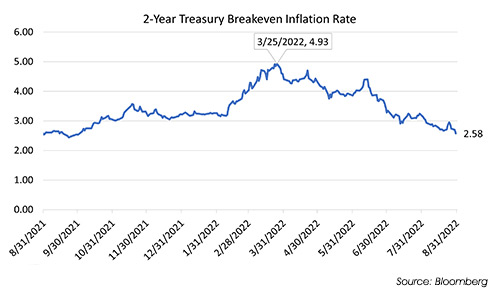

Although the near-term market picture is likely to remain volatile given the uncertainty of the extent

to which conditions will be tightened, financial markets reflect the belief that the Federal Reserve will be successful in its mission to restore price stability. U.S. Treasuries began discounting improving inflation metrics several months ago with

yields now reflecting annual inflation of 2.58% over the next two years compared to 4.93% back at the peak in March.

Although the near-term market picture is likely to remain volatile given the uncertainty of the extent

to which conditions will be tightened, financial markets reflect the belief that the Federal Reserve will be successful in its mission to restore price stability. U.S. Treasuries began discounting improving inflation metrics several months ago with

yields now reflecting annual inflation of 2.58% over the next two years compared to 4.93% back at the peak in March.

At First Merchants Private Wealth Advisors we strive to focus less on the timing of the next recession and more on the long-term value of selecting investments in high quality, self-sustaining companies and institutions with strong balance sheets and robust cash flows that can withstand the ebb and flow of economic cycles on behalf our clients. In many cases, these businesses emerge even more valuable from economic dislocations as they can take market share from competitors playing defense and purchase assets selling at discounts from those needing liquidity. Similarly, we look to take advantage of market dislocations to buy strong businesses selling at discounts to their intrinsic value and then allow those investments to compound for the long-term. As always, we are here to help navigate the risks and opportunities of these uncertain times. Please don’t hesitate to reach out to your advisor with any questions or concerns.

David Pfeiffer

First Merchants Private Wealth Advisors products are not FDIC insured, are not deposits of First Merchants Bank, are not guaranteed by any federal government agency, and may lose value. Investments are not guaranteed by First Merchants Bank and are not insured by any government agency. This material has been prepared solely for informational purposes. First Merchants shall not be liable for any errors or delays in the data or information, or for any actions taken in reliance thereon. Any views or opinions in this message are solely those of the author and do not necessarily represent those of the organization.