As a runner, and I use the term “runner” loosely when describing myself, I’m always measuring my progress. Whether it’s a training run or actual race, I’m monitoring my pace throughout. This lets me know if I’m ahead or behind my desired finish time. Do I need to push harder, or am I able to conserve energy for later? I’ve yet to find a dishonest stopwatch. This concept should be applied to saving for retirement, which is a multi-decade journey for most of us. While collecting information on this topic, I discovered some of my old “rule of thumb” assumptions had become, well… old.

For years, I had been quoting retirement savings targets as:

- Age 30 should have 0.5x current income saved.

- Age 35 = 1x, 40 = 2x, 45 = 3x, 50 = 4x, 55 = 5x, 60 = 6x, 65 = 7x

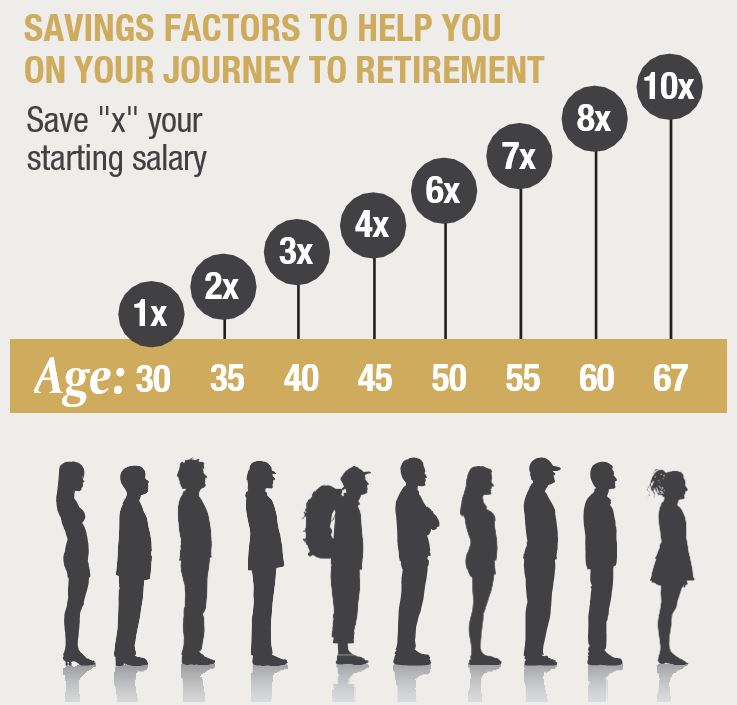

Currently, Fidelity Investments is saying:

- Age 30 should have 1x current income saved.

- Age 35 = 2x, 40 = 3x, 45 = 4x, 50 = 6x, 55 = 7x, 60 = 8x, 67 = 10x

Hard to know exactly when my old assumptions became antiquated and my apologies to the 50-year-old

who has 4x income saved and is now being told it should be 6x income. Earning $80,000 means that $320,000 nest egg now should be $480,000. That’s quite a jump. In reality, the 50-year-old with $320,000 will likely be fine but it’s still

good to know they should probably aim higher. The rub here is most 50-year-olds don’t have near that saved. According to a 2020 report from Vanguard, the average 401(k) balance for ages 45-54 is $135,777. That balance would be the goal for a

50-year-old earning $22,630 a year. What’s worse, the median saver in that age bracket only has $46,363. We’ve heard Americans are behind in their savings and here’s the proof. What can be done? Is it too late? Not exactly. Here’s

an encouraging illustration:

Hard to know exactly when my old assumptions became antiquated and my apologies to the 50-year-old

who has 4x income saved and is now being told it should be 6x income. Earning $80,000 means that $320,000 nest egg now should be $480,000. That’s quite a jump. In reality, the 50-year-old with $320,000 will likely be fine but it’s still

good to know they should probably aim higher. The rub here is most 50-year-olds don’t have near that saved. According to a 2020 report from Vanguard, the average 401(k) balance for ages 45-54 is $135,777. That balance would be the goal for a

50-year-old earning $22,630 a year. What’s worse, the median saver in that age bracket only has $46,363. We’ve heard Americans are behind in their savings and here’s the proof. What can be done? Is it too late? Not exactly. Here’s

an encouraging illustration:

- Initial Age: 50

- Initial investment: $46,363

- Monthly contribution: $1,000 (could include an employer contribution)

- Length of time: 17 years (to age 67)

- Estimated interest rate: 8.5%

- Interest rate variance: 1.0

- Ending balance: $609,405.68 (8.5%), $681,438 (9.5%), $545,627 (7.5%

Those ending balances may or may not equate to 10x income at age 67, but this looks encouraging and doable. In this case, the 17-year timeframe still delivered a respectable balance through periodic investing and compounding. The key takeaways here are 1.) Monitoring your progress and adjusting accordingly are keys to building a sufficient nest egg and 2.) Don’t get discouraged by thinking it’s too late; it may not be. A rather sizeable participation medal could be waiting for you at the finish line!

Kris Feldmeyer

First Merchants Private Wealth Advisors products are not FDIC insured, are not deposits of First Merchants Bank, are not guaranteed by any federal government agency, and may lose value. Investments are not guaranteed by First Merchants Bank and are not insured by any government agency. This material has been prepared solely for informational purposes. First Merchants shall not be liable for any errors or delays in the data or information, or for any actions taken in reliance thereon. Any views or opinions in this message are solely those of the author and do not necessarily represent those of the organization.