U.S. equities broadly posted their strongest weekly performance since last November as investor sentiment was boosted by receding fears of a banking crisis and positive economic data. Renewed buying in growth stocks in the technology and consumer discretionary sectors also helped propel major indices higher. For the week, the S&P 500 advanced 3.5% after posting gains in four out of five sessions, while the Dow Jones and Nasdaq Composite gained 3.2% and 3.4%, respectively.

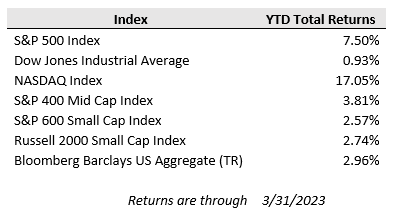

This year’s renewed interest in technology stocks helped the Nasdaq 100 push back into bull market territory, with the index up more than 20% from its lowest closing level in December last year. The tech-heavy index also logged its best quarterly performance since June 2020, surging 17.1% in the first quarter, compared to gains of 7.5% for the S&P 500 and just 0.9% for the Dow Jones. This remarkable divergence demonstrates the outsized gains seen by tech stocks in the first quarter compared to more modest gains elsewhere in equity markets. In fact, seven mega-cap tech stocks (Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, and Meta) accounted for 82% of the S&P 500’s return in the first quarter.

While financial system uncertainty remains elevated, fears of a banking crisis have ebbed somewhat as financial regulators and other lenders are stepping in with measures to stem the fallout from the most notable banking system turmoil in 14 years. Bank borrowing from the Federal Reserve fell by $11.3B last week, an encouraging indication of calming conditions, as the amount of borrowing from the Fed's discount window dropped more than the use of the new lending facility increased. The Senate Banking Committee also held a hearing on the recent bank closures, which shone a spotlight on failures in the overall regulatory system.

The February Personal Income and Outlays report revealed that U.S. consumer spending and price pressures cooled in February. Personal spending growth eased from 2.0% month-over-month in January to 0.2% – slightly below expectations of 0.3%. Spending on durable goods declined by 1.4% in February while spending on both nondurable goods and services eased. Overall consumption declined by 0.1% in real terms for the month with spending on both durable goods (-1.2%) and services (-0.1%) decreasing.

On the inflation front, both the headline and core PCE deflators eased in February and for the most part fell below consensus estimates. Headline PCE inflation slowed from 5.3% year-over-year to 5.0% (0.3% month-over-month) while the core measure ticked down from 4.7% to 4.6% (0.3% month-over-month).

However, it isn’t all good news on the inflation front as this week begins with oil prices soaring on a surprise OPEC+ production cut. Brent crude was trading near a one-month high this morning after Saudi Arabia, Russia and their oil-producing allies said they would reduce output by roughly 1.2 million barrels per day. The White House criticized the decision, fearing it would lead to higher prices for motorists and a revenue windfall for Russia’s war effort. The reduction, led by Saudi Arabia, will start in May and last until the end of 2023. Russia's recent production cuts of 500K barrels per day were also extended and add to the 2 million bpd that were taken offline by OPEC+ in October. Together, both rounds of cuts mean that 3% of the world's oil has been removed from the market in the past six months.

U.S. and most European markets will be closed for Good Friday, but investors will still be tuning into the U.S. jobs report, scheduled for release at 8:30 a.m. ET. Economists polled by Reuters forecast that employers made 240,000 hires last month. Wage gains will be the big focus for the markets.