Monday, July 31, 2023

Investment Management: First Half Recap & Second Half Outlook

Pessimism turned to optimism in the U.S. financial markets as the calendar turned from 2022 to 2023. After enduring inflation levels at 40-year highs, seven rate hikes from the Federal Reserve, equity market returns of -20% and bond market returns of -13%, investors were eager to leave 2022 behind. As inflation began to show signs of slowing, equity markets moved upward early in the year amid hopes that the Federal Reserve’s rate hike cycle was nearing an end. The recovery was firmly underway until early March when cryptocurrency focused Silvergate Bank announced it was closing down operations due to losses suffered in its loan portfolio. Two days later, on March 10, a bank run at San Francisco based Silicon Valley Bank caused it to collapse and be seized by regulators later that day. On March 12, regulators closed Signature Bank, a New York based bank that also focused on the cryptocurrency industry. The bank failures put significant pressure on the financial system as concern spread among investors over the safety of the U.S. banking system, and regional banks in particular. Depositors began withdrawing cash from some regional banks, with San Francisco-based First Republic Bank losing $100 billion in deposits by the end of March. Despite a $30 billion lifeline from a group of major U.S. banks and $70 billion in financing from JPMorgan Chase, First Republic Bank was closed by California regulators on May 1 and its assets were sold to JPMorgan Chase. The collapses of First Republic Bank, Silicon Valley Bank and Signature Bank were the second, third and fourth largest bank failures in the history of the United States, eclipsed in size only by the failure of Washington Mutual during the 2007-2008 financial crisis. We agree with RBC Wealth Management’s Atul Bhatia, who wrote in April that “A crisis for a few banks is not a banking crisis”. This is not a systemic problem encompassing the entire financial system as with the 2008-2009 financial crisis, but rather a contained event involving a limited number of banks with similar elevated risk profiles.

Thanks to a quick response from the Federal Reserve to put some special liquidity instruments in place to limit the fallout across the banking sector, market concerns began to fade and the focus turned to the looming debt ceiling deadline. The country

had actually hit its debt ceiling on January 19, 2023, and had been acting under “extraordinary measures” since that time. Treasury Secretary Janet Yellen warned that these measures could be exhausted as early as June 1st. Markets remained

cautious as the date loomed closer with no agreement reached between President Biden and House Speaker Kevin McCarthy. Finally on May 27, Biden and McCarthy struck a deal to increase the debt ceiling but cap federal spending. The deal resulted in

the bill known as the Fiscal Responsibility Act of 2023 which passed the House on May 31, the Senate on June 1, and was signed into law by President Biden on June 3, bringing the crisis to an end. Some of the provisions in the bill include: The suspension

of the debt limit until January 1, 2025, discretionary spending capped for fiscal years 2024 and 2025, rescind all unused funds appropriated during the COVID-19 pandemic, rescind 25% of the $80 billion in additional funding for the IRS provided for

in the Inflation Reduction Act of 2022, and the student loan payment moratorium enacted in 2020 is to end on September 1, 2023.

Thanks to a quick response from the Federal Reserve to put some special liquidity instruments in place to limit the fallout across the banking sector, market concerns began to fade and the focus turned to the looming debt ceiling deadline. The country

had actually hit its debt ceiling on January 19, 2023, and had been acting under “extraordinary measures” since that time. Treasury Secretary Janet Yellen warned that these measures could be exhausted as early as June 1st. Markets remained

cautious as the date loomed closer with no agreement reached between President Biden and House Speaker Kevin McCarthy. Finally on May 27, Biden and McCarthy struck a deal to increase the debt ceiling but cap federal spending. The deal resulted in

the bill known as the Fiscal Responsibility Act of 2023 which passed the House on May 31, the Senate on June 1, and was signed into law by President Biden on June 3, bringing the crisis to an end. Some of the provisions in the bill include: The suspension

of the debt limit until January 1, 2025, discretionary spending capped for fiscal years 2024 and 2025, rescind all unused funds appropriated during the COVID-19 pandemic, rescind 25% of the $80 billion in additional funding for the IRS provided for

in the Inflation Reduction Act of 2022, and the student loan payment moratorium enacted in 2020 is to end on September 1, 2023.

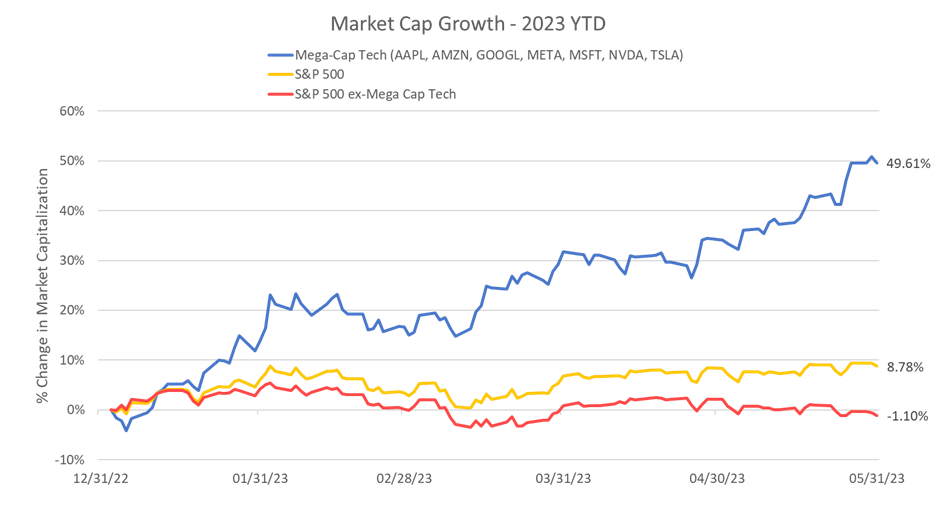

With the banking system and debt ceiling uncertainties resolved, markets looked to end the first half of the year on an upswing. At their June meeting, the Federal Reserve elected to hold rates steady, after raising the Federal Funds Rate at each of the prior ten meetings. A broad stock market recovery seemed underway, with the S&P 500 rising nearly 9% on the year through May. In reality, the breadth of the market resurgence was actually very narrow. While seven Mega-Cap technology related names (Apple, Amazon, Microsoft, Google, Meta, Nvidia, Tesla) had a cumulative market cap growth of nearly 50% through May, the other 493 stocks in the S&P 500 had a cumulative market cap growth of -1.1% over that time. In other words, without the performance of those seven stocks, the return of the S&P 500 would have actually be flat to slightly negative. There is also a disconnect between the market capitalization of the largest stocks in the S&P 500 vs. the amount of earnings they produce. Currently the ten largest stocks in the S&P 500 represent 32% of the value of the index but produce only 21.6% of its earnings. This differential is significantly larger than even that of the “dot com bubble” years of 1999 – 2000. The narrow bull market leadership will be one trend we’ll be watching in the second half of 2023.

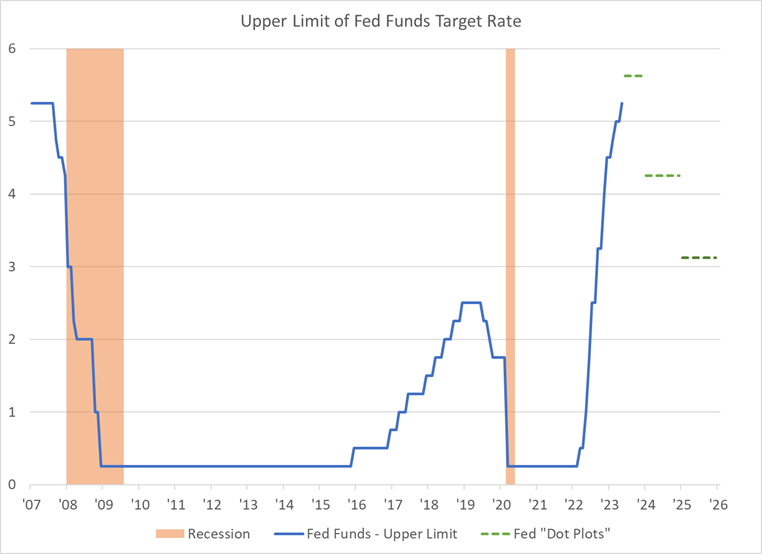

While exuberance over the rising popularity of Artificial Intelligence (AI) drove the outsized returns among a select few technology stocks in the first half of the year, we remain cautious about the staying power of the resulting elevated valuations. As the novelty of the “AI Takeover” wears off, we expect valuations for AI related names to return to more reasonable levels in the months ahead. Cautiousness also prevails in our attitude surrounding the immediate path forward for the Federal Reserve. While earlier forecasts indicated the June Fed meeting to be the peak of the rate hike cycle, current projections are signaling more rate hikes ahead. The Fed’s “dot plot,” a graphic showing the future path of the expected Federal Funds Rate, with each dot representing the rate expectation of a Federal Open Market Committee member, now shows two more hikes ahead. In Fed Chairman Jerome Powell’s June press conference, he was quick to point out that “not a single person on the committee wrote down a rate cut this year, nor do I think it is at all likely to be appropriate.” Powell went on to say he doesn’t see a rate cut coming until inflation comes down meaningfully and significantly, to which he added, “we’re talking about a couple of years out.” Although one half of the Fed’s dual mandate, price stability (low inflation), has garnered most of the headlines, the other half of the mandate, maximum sustainable employment, remains worth watching going forward. Since the current unemployment rate remains well below the Noncyclical Rate of Unemployment trend line, there is nothing signaling the need for a rate cut on the unemployment front at this time. With both sides of the Fed’s mandate signaling continued tightening of monetary policy, it creates the potential to become an obstacle for stocks. Given the types of stocks that have rallied the most, persistently high rates could work like a vise tightening on the economy and weighing on growth. Based on history, the Fed typically tightens until something breaks. In this case, it could be the consumer. Given that consumer spending drives roughly two thirds of our nation’s GDP, it’s an important indicator. Metrics show consumer spending is cooling but not yet falling off a cliff. Cracks are beginning to show, however, as excess consumer savings from the Covid pandemic have dried up and credit card usage and payment delinquencies have ramped up. Total U.S. consumer credit card balances outstanding have now passed $1.2 trillion for the first time ever. Persistently higher interest rates will make the desired economic “soft landing” considerably harder for the Federal Reserve to achieve.

As we consider how to position investments for the remainder of the year, we have already taken a step

to de-risk portfolios by significantly reducing our exposure to high yield bonds. The additional risk of owning high yield bonds in a slowing economic environment outweighs the potential rewards. In addition, we will also be looking at equity market

valuations and asset allocations that could potentially provide higher expected returns going forward. Based on current equity market valuations versus long-term historical trends, international developed and emerging market equities appear to be

attractively valued relative to U.S. large cap stocks. Bonds have found a renewed role in portfolios as well, with yields rising to levels last seen some 15 years ago. With short-term Treasury Bills yielding over 5% and investment grade corporate

bonds providing yields over 6%, there are finally sensible alternatives in the fixed income space after years of ultra-low interest rates. We thank you for your continued confidence in First Merchants Private Wealth Advisors. As always, please reach

out to a member of your First Merchants PWA team with any comments or questions. We look forward to a sustained partnership with you throughout the remainder of 2023 and beyond!

As we consider how to position investments for the remainder of the year, we have already taken a step

to de-risk portfolios by significantly reducing our exposure to high yield bonds. The additional risk of owning high yield bonds in a slowing economic environment outweighs the potential rewards. In addition, we will also be looking at equity market

valuations and asset allocations that could potentially provide higher expected returns going forward. Based on current equity market valuations versus long-term historical trends, international developed and emerging market equities appear to be

attractively valued relative to U.S. large cap stocks. Bonds have found a renewed role in portfolios as well, with yields rising to levels last seen some 15 years ago. With short-term Treasury Bills yielding over 5% and investment grade corporate

bonds providing yields over 6%, there are finally sensible alternatives in the fixed income space after years of ultra-low interest rates. We thank you for your continued confidence in First Merchants Private Wealth Advisors. As always, please reach

out to a member of your First Merchants PWA team with any comments or questions. We look forward to a sustained partnership with you throughout the remainder of 2023 and beyond!

Travis McEowen

Portfolio Manager

First Merchants Private Wealth Advisors products are not FDIC insured, are not deposits of First Merchants Bank, are not guaranteed by any federal government agency, and may lose value. Investments are not guaranteed by First Merchants Bank and are not insured by any government agency. This material has been prepared solely for informational purposes. First Merchants shall not be liable for any errors or delays in the data or information, or for any actions taken in reliance thereon. Any views or opinions in this message are solely those of the author and do not necessarily represent those of the organization.