SBA Lending

An SBA Preferred Lender

First Merchants Bank works with qualified small businesses to secure financing when they might not be eligible for business loans through conventional lending channels. We are a Small Business Administration (SBA) Preferred Lender, which demonstrates SBA’s recognition of our expertise and dedication to serving the small business community. Using our Preferred Lender status makes the loan process* faster and more efficient.

Customized SBA Financing Solutions:

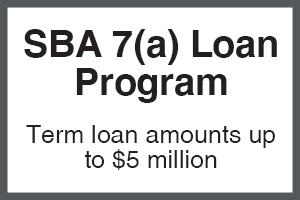

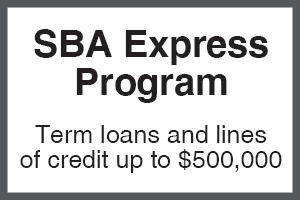

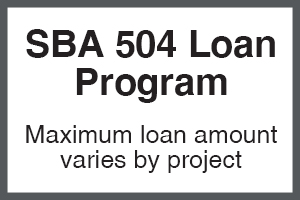

We offer SBA 7(a) term loans, SBA Express term loans and lines of credit, and SBA 504 fixed asset financing. These products may be used together as well as paired with other Conventional financing options.

First Merchants knows how to navigate the application process and to get the right financing options for the needs of our customers and their stakeholders. We offer financing solutions for every purpose permitted under the SBA loan programs, including:

- Business Acquisitions and Partner Buyouts

- Franchise Lending

- Business Expansions

- Purchasing Real Estate

- Constructing or Renovating a Building

- Inventory

- Fixed assets: Machinery or Equipment

- Working Capital

- Refinance Existing Business Debt

- Furniture and Fixtures

- Startups

*Loans subject to credit application and approval. SBA loans subject to SBA eligibility.

(Approved to offer SBA loan products under SBA’s Preferred Lender and Express program.)