Retirement Planning

Why First Merchants Retirement Plan Services?

1. We’re Proud to Offer:

- Plan Design & Analysis

- Financial Planning Education for Businesses

- One-on-One Support

- Investment Selection Assistance

- Ongoing Investment Monitoring

- Plan Benchmarking

- Group/Education Meetings

2. A Team You Can Trust

When it comes to growing and protecting what you’ve built, you need access to a team that understands your goals, cares about your personal journey, and offers in-depth financial knowledge. That’s why First Merchants’ team approach ensures long-lasting relationships between your employees and our group of professionals, so you always have access to the attention and expertise you deserve.

By working with First Merchants, you connect with a network of financial professionals with your best interest in mind. We work in conjunction with outside partners from the tax, accounting, and legal fields to protect what you built your lives on. We also ensure your family and business relationships are as engaged in the conversation as you want and work to understand your evolving goals, allowing a dynamic financial strategy that grows and changes with you and your business. We understand each business and business owners financial needs are unique, and we are proud to create solutions together. With First Merchants Private Wealth professionals on your side, you can have full confidence your financial dreams are secure for generations to come.

3. A Retirement Plan as Unique as Your Goals

You can expect clear, custom solutions when you work with our private wealth team on your retirement plan. First, we assess your current situation by reviewing your plan document and platform of funds. Then we can evaluate your short- and long-term goals for yourself and your employees. We consider the tax impact of your goals and how to best manage your retirement plan for you personally, your employees, and for attracting quality team members for the future. From there, we can review and implement a strategy with well-defined recommendations. Because you have access to a full team of banking professionals, we will always have someone available to address your needs. This approach provides access to the most experienced and attentive specialists. With First Merchants on your side you can have full confidence that your dreams, and the dreams of your team, for retirement become reality.

We offer a full range of retirement solutions and guidance to match whatever your needs might be.

- Plan Design & Analysis – We work with you to make sure your plan is perfectly tailored to your needs now and revisit the plan features in the future. Just like your business grows and changes, your plan design may need to change as well. Based on your goals, we use our experience to create a custom plan design and check that design against our rigorous standards to ensure your plan is compliant with ERISA and will get you ready for retirement.

- Education – Knowledge is power, and, as advocated for your financial future, we collaborate with you to design a financial education model that fits your individual or business needs. We’ll be with you every step of the way – from helping to enroll yourself and your team to providing assistance during plan implementation, as well as ongoing education.

- One-on-One Support – Our role doesn’t stop at implementation – we make ourselves personally available to plan participants and sponsors on a continual basis. With First Merchants Private Wealth Advisors, you’ll always have the support you need to help you reach the finish line.

- Investment Selection Assistance – We follow strict guidelines and rigorous internal checks to comply with all state and federal guidelines, including Regulation 404(c).

- Ongoing Investment Monitoring – We regularly review investments against our peers to ensure you are receiving the highest quality returns on your hard-earned funds. Plan Benchmarking – We continually review performance and conduct analyses to keep your plan in line with your goals. We’ll contact you with updates and provide you with top-tier advice to ensure the funds offered are of good quality and of competitive pricing in order to help you reach your goals more quickly.

4. Financial Wellness Plan Program

Program Overview

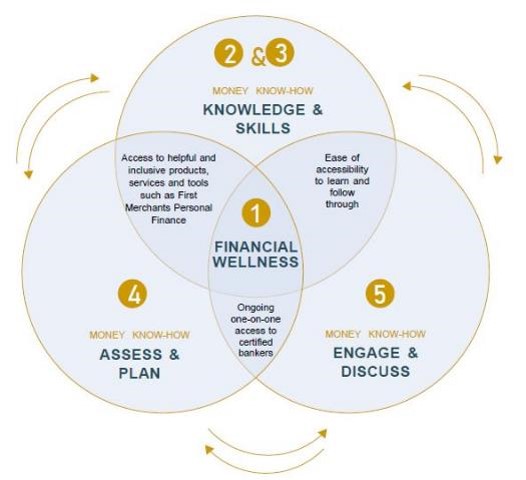

The Financial Wellness Program at First Merchants consists of three financial wellness drivers working together in concert to create financial well-being for our audiences.

- Knowledge & Skills - access to accurate, relevant, timely and understandable education

- Assess & Plan - Tools to know where you stand

- Engage & Discuss - Welcoming, attentive and dependable bankers and useful products

Program Distribution

Workshops We Offer

First Merchants offers branded, employee-led financial wellness workshop on a variety of topics (in English and Spanish) including:

|

Banking Basics |

Business Succession Planning |

Coming Soon:

|

Identify Theft |

Business Banking Basics and Borrowing |

Digital Financial Wellness Resources

- Includes articles, calculators and more for any financial wellness topic

- From courses to tools, Enrich offers a variety of resources to improve your overall financial wellness

- Recorded sessions available

- Future live sessions will be offered Example: Retirement and Investment Basics

The Expertise Our Team Delivers

We’re with you, every step of the way – working to keep you focused on your goals in order to maximize your savings, minimize your taxes, and make your retirement fund last.