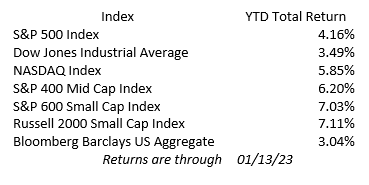

The second week of the year showed gains for our major indexes. Weekly performance for the S&P 500 was up 2.67%, the Dow Jones was up 2.00%, and the NASDAQ was up 4.82%. Mid Cap and Small Cap stocks rebounded as well, with the S&P 400 Mid Cap up 3.65%, the S&P 600 Small Cap up 4.47%, and the Russell 2000 Small Cap up 5.26% for the week. Bonds were not left out and the Bloomberg Barclay US Aggregate bond index was up 1.25% for the week.

December Consumer Price Index (CPI) fell 0.1% matching expectations. The year-over-year increase (not seasonally adjusted) came in at 6.5%, down from 7.1% in November. The Core CPI (excluding food and energy) rose 0.3% as expected, for a 5.7% year-on-year increase. December was the third consecutive month of lower inflation making it more likely the Fed will be able to reduce the pace of rate hikes at the next meeting. The market now expects a 25-basis point hike in February. Earnings season started Friday with financial and healthcare names reporting. The markets had a rocky start as some big banks like JP Morgan, Bank of America and Wells Fargo reported. However, the markets seemed to settle down and bounce back. Some factors such as continuing solid loan growth, a healthy consumer, and strong corporate balance sheets certainly helped. Healthcare was mixed with managed care, pharma, and biotech faring well.

In other top stories for last week, the University of Michigan Consumer Sentiment Survey (January Preliminary) was up 4.9 points month-over-month to 64.6, beating estimates for 60.3. This was the second straight gain and the highest in nine months. US Consumer Credit rose by $27.96 billion in November of 2022, which was above expectations of a $25 billion increase. In addition, the previous month was revised up to $29.12 billion. Those numbers show on an annual basis consumer credit up by 7.1% in November and 7.4% in October. Revolving credit, like credit cards, jumped 16.9% in November compared to 10.3% increase in October. Non-revolving credit, like car loans increased 3.9% and 6.5% respectively.

Last week the number of Americans filing new claims for unemployment fell by 1,000 to 205,000. Consensus expected 215,000. This was the lowest value in over three months. The 4-week moving average fell by 1,750 to 212,500. On a non-seasonally adjusted basis initial claims shot up 60,799 to 339,286. Continuing jobless claims, for period ending 12/31/22, came in at 1634 thousand. Down from the previous week of 1697 thousand.

This holiday-shortened week is filled with economic releases. The Producer Price Index (PPI), Retail Sales, Industrial and Manufacturing Production, and business inventories will post on Wednesday. Thursday brings news on housing. Core PPI is expected to be flat to up 0.10%, which is down from the prior month of +0.40%. Retail sales are expected to go down for the month of December continuing the drop from the previous month. Industrial production and manufacturing also are expected to decline. Business inventories are expected to increase 0.40% after an increase of 0.30% previously. All these economic releases are showing a slowing economy and disinflationary story; something the Fed is working to see by increasing interest rates and working toward a soft landing.