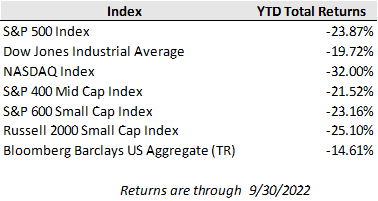

Financial markets broadly tumbled last week to close out an ugly month of September, which saw a sharp rise in global interest rates as central banks ramped up the policy tightening pressure to rein in inflation. The U.S. 10-year Treasury rose to 3.80% at the end of September and touched as high as 4.0% last week after starting the month at just 3.11%. The sharp increase dealt a blow to stocks and bonds alike as the Bloomberg U.S. Aggregate Bond index fell 4.3% and the S&P 500 tumbled 9.2% in September following last week’s losses of 1.0% and 2.9%, respectively.

Meanwhile, the U.S. dollar—supported by relative economic resilience and rising interest rates beyond other developed economies—continued to strengthen against foreign currencies with the U.S. dollar index up nearly 17% through the first three quarters of the year. While many countries may look to reduce their dollar dependence in the future, at this point the U.S. dollar remains the oxygen to global economic and market activity with much of the world’s trade, commodity prices, and financing denominated in the currency.

There were several drivers behind the recent sharp move higher in interest rates. The disappointing August consumer price index report was certainly a catalyst as food and core service price growth accelerated during the month and increased rate hike expectations. But the rate volatility was further fueled by the acceleration of the Federal Reserve’s bond portfolio run-off (also known as quantitative tightening) and by efforts from foreign governments to defend against the rising U.S. dollar. Starting in September, the Federal Reserve doubled the pace of its reduction of Treasuries and mortgage-backed security holdings to reduce its balance sheet by $95 billion per month. Meanwhile, foreign governments have had to sell U.S. Treasury reserve holdings as dollar liquidity dries up and their currencies weaken. Both factors have increased the supply of Treasury bonds on the market to be absorbed by other investors, thereby pushing up yields further.

The Federal Reserve’s aggressive tightening plans, slowing global economic activity, and rising U.S. dollar strength have started to expose cracks in the more vulnerable areas of global markets. Last week, the Bank of England announced that they were reversing course with their quantitative tightening plans and would instead start buying back bonds in response to a surge in yields that threatened to create more forced selling of government bonds by pensions funds and insurance companies. Then over the weekend, concerns began to mount around the financial strength of several European banks (most notably Swiss-bank Credit Suisse), as their bond prices sank and the cost to insure against default rose sharply. While we have long maintained a cautious view on European banks during the past decade of negative interest rates and slow growth, we would note that Credit Suisse remains in a strong capital position (one of the best capitalized in Europe by regulatory measures) with a quite liquid balance sheet. We don’t see the recent market reaction turning into broader financial contagion risk at this point.

In the U.S., the spike in mortgage rates has started to push down median home prices on a monthly basis, though they are still rising year-over-year. Black Knight — a specialist in data and analytics for mortgage and real estate — says median prices fell 1.05% in July and 0.98% in August, the largest declines since January 2009. However, the median price is still up 12.1% year-over-year. The biggest declines are on the west coast where San Jose is down 13% from its 2022 peak, San Francisco is down 11%, and Seattle is down 9.9%.

In all, with the Fed pursuing the sharpest rate of monetary policy tightening on record and other central banks following suite, there are broadening indications that the aggressive policy stance is having the desired effect of slowing economic activity to tamp down inflation. Our investment team will continue to monitor the economic fallout and risks stemming from tight policy, while also keeping an eye toward the opportunities created. For example, we are seeing improving opportunities in high-quality, short-term fixed income where yields are pushing beyond expected inflation and better compensating against further interest-rate risk. As always, we will keep you apprised of key economic and market developments and please don’t hesitate to reach out to your advisor with questions.