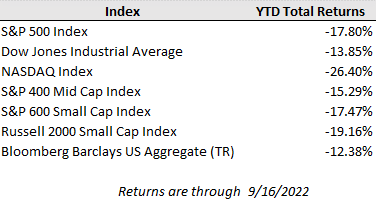

Last week’s upside surprise on inflation sent U.S. interest rates higher and equity markets lower as the market readjusted to reflect increasing expectations for the ultimate level of rate hikes and the length of time they would be held there. The peak federal funds rate priced into the market is now 4.5% by March of next year, according to FactSet. In response, the S&P 500 tumbled 4.8% lower last week, while the Dow Jones and Nasdaq Composite lost 4.1% and 5.5%, respectively. The two-year U.S. Treasury yield soared to 3.85% and is quickly advancing on 4.00% from 3.57% a week ago, while the 10-year Treasury yield has surpassed its June highs as it heads toward 3.50%.

Such a sharp rise in interest rates may keep the pressure on equity markets near-term not only because higher discount rates reduce the present value of future earnings, but also because there is now an increasingly compelling investment alternative after many years of suppressed bond yields forced investors into riskier avenues like stocks to meet their return goals. Fewer than 20% of stocks in the S&P 500 have a dividend yield surpassing the 10-year Treasury yield currently, which marks the lowest percentage since 2006, according to Strategas. The S&P 500 now yields 1.60% in aggregate, though it is also important to keep dividend growth in mind as the index has compounded its overall dividend at nearly 7% per year for the last decade, and that doesn’t account for the growing prevalence of share buybacks as a way of returning capital to shareholders.

While the U.S. consumer is being pressed on several fronts by rising rates, financial market volatility, inflation outpacing wage growth, and a drop-off in fiscal stimulus, consumption has remained resilient to this point (albeit cooling). Strong job prospects, healthy balance sheets, and excess stimulus savings have helped offset spending headwinds so far, but market participants will be watching consumer data very closely for any deterioration in trends.

Last week’s consumer data was a mixed bag, but generally cooler than expected. August retail sales posted solid headline growth of 0.3% over July, but most of the growth was driven by auto sales (retail sales were -0.3% ex-autos) and July’s retail sales were revised lower to -0.4% from the initial report of flat sales on the month. Meanwhile, FedEx preannounced a significant revenue and earnings miss from a sharp drop in package deliveries on their first fiscal quarter results ending in August, which sent the stock down 21%. However, much of the weakness in FedEx’s results may stem from company specific issues rather than a commentary on the macro picture, particularly as consumers have shifted spending towards services over goods in recent months. Large financial service companies, like Goldman Sachs, have taken the flip side of FedEx’s outlook, noting persistently strong credit trends, and industrial conglomerates have pointed to strength across a host of end markets including autos, non-residential construction, and infrastructure.

In the week ahead, the spotlight will be on the Federal Reserve following the September FOMC meeting set to conclude on Wednesday. Consensus expectations are for a 0.75% rate increase this week, though the market is pricing in some potential for a full 1.00% increase due to the hotter than expected August CPI reading. A 0.75% rate hike, which would be the third of that size in a row, would take the target federal funds rate to 3.0-3.25%. Investors will also be listening for any commentary on the Fed’s balance sheet reduction as the central bank has accelerated the pace of bond sales this month, potentially adding further pressure to the upward move in interest rates as the supply of bonds in the market rises.