Attentive Banking Stands the Test of Time

For more than 130 years, First Merchants has been building a bank that's different. One that's focused on the needs of our customers. In fact, an advertisement from 1914 reads, "The bank of personal service is one of the business creeds of our bank. It is the desire of the management to extend individual service to each one of its customers, to give courteous and watchful attention to their individual needs."

While much has changed about banking since 1914, our commitment to attentive service is unwavering.

Our History of Attentive Banking

1893

The

Merchants National Bank of Muncie was founded by local former schoolteacher and wholesale grocer, Hardin Roads, and a group of service-minded businesspeople during the Panic of 1893. The group, led by Roads, recognized a need in the community and

raised capital of $100,000 to organize The Merchants National Bank of Muncie, which was incorporated on February 3, 1893.

The

Merchants National Bank of Muncie was founded by local former schoolteacher and wholesale grocer, Hardin Roads, and a group of service-minded businesspeople during the Panic of 1893. The group, led by Roads, recognized a need in the community and

raised capital of $100,000 to organize The Merchants National Bank of Muncie, which was incorporated on February 3, 1893.

The original bank was in a room at the northeast corner of Main and Mulberry Streets in Muncie, Ind., then known as the Little Block. In 1904, the bank’s main office moved to larger quarters across the street, to the northwest corner of the same intersection, in what was known as the Neely Block. Ten years later, in 1914, the bank settled into its "new" building at Jackson and Mulberry Streets. With its impressive Corinthian columns, this familiar Muncie landmark served for 58 years, undergoing two major renovations.

1920s – 1940s

Frank

Bernard succeeded as President when Mr. Roads died in 1923. During the Great Depression, the bank operated business as usual and did not limit depositor withdrawals — despite the depression’s enforced “Bank Holiday.” Because

of the bank's sound economic position, Muncie continued to do business as usual when money - even one's own - was not always available elsewhere.

Frank

Bernard succeeded as President when Mr. Roads died in 1923. During the Great Depression, the bank operated business as usual and did not limit depositor withdrawals — despite the depression’s enforced “Bank Holiday.” Because

of the bank's sound economic position, Muncie continued to do business as usual when money - even one's own - was not always available elsewhere.

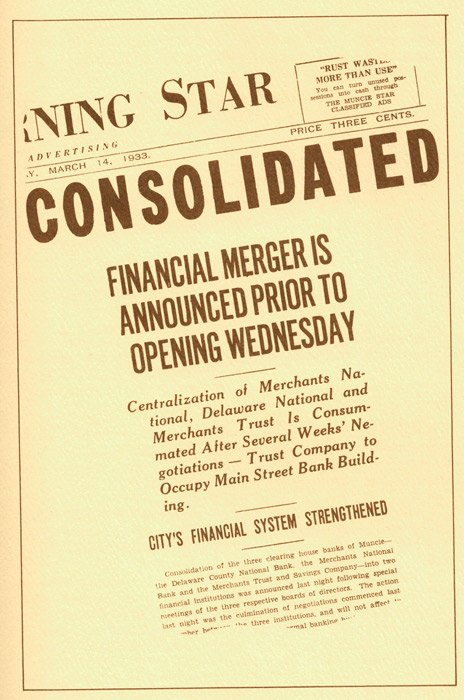

Merchants National Bank of Muncie announced its merger in 1933 with Delaware County National Bank of Muncie and Merchants Trust & Savings Company. Merchants National Bank of Muncie and Merchants Trust survived the consolidation. These two banks were reorganized as independent institutions in 1946, the same year Chester Wingate was elected President of First Merchants Bank on the retirement of Frank Bernard.

1950s – 1970s

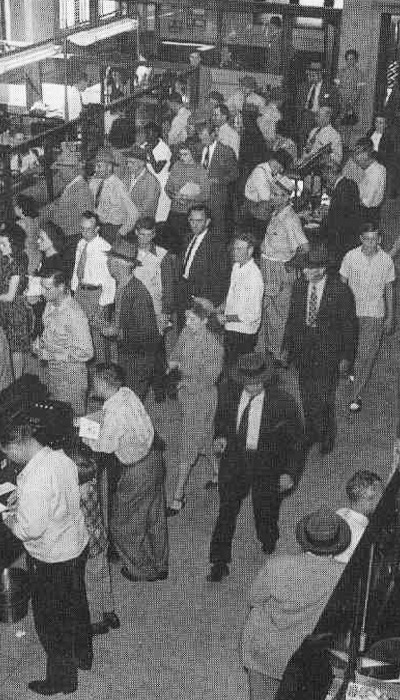

Branch banking started in Delaware County in 1951 when Merchants National Bank of Muncie opened its Madison Street branch. The growing bank added two more branches with the purchase of the Muncie Banking Company in 1953.

With the election of William P. Givens as the fourth president of the bank, Merchants National Bank entered a “new era” in 1958. The bank achieved record levels in all facets of banking activities, including loans, investments, and trusts.

During the 1960s, the bank opened four new branch offices - East Jackson in 1962, Northwest in 1963, Meadows in 1968, and Kilgore Avenue in 1969. Other areas were expanded with the move to automation by way of computerized accounting in 1965. In 1967, the bank purchased the former office of Indiana Steel & Wire Company and converted it into one of the most modern data centers in East Central Indiana.

During the “Soaring Sixties,” the bank's total resources soared above $100,000,000 — a first for any financial institution in Delaware County, Ind.

The bank continued to open more branches during this era and quickly continued to grow. The bank's main office headquarters moved into a new building at 200 East Jackson Street in 1972 to maintain friendly, personalized service while meeting the demand for more robust banking services. The bank's Impressive new main office also represented Its commitment to the commercial vitality of Muncie's central business district.

The 1970s saw remarkable growth for Merchants National Bank, with assets more than doubling from $115,333,227 in 1970 to $259,476,964 in 1979.

In February of 1979, Stefan S. Anderson was elected the new President of The Merchants National Bank. Mr. Anderson became the 5th president in the bank's 86-year history. The challenge of the 80's was about to begin.

1980s – 2000s

The Merchants National Bank reaffirmed its longstanding commitment to community leadership through the dedicated efforts of its experienced employees and faced the rapidly changing conditions of the financial industry during this new decade through economic challenges, new services, new competition, new objectives, and advancements in technology.

In 1982, The Merchants National Bank's Board of Directors approved the formation of a one-bank holding company, First Merchants Corporation — enabling increased flexibility in navigating the quickly and dramatically changing financial services industry and for future growth and expansion.

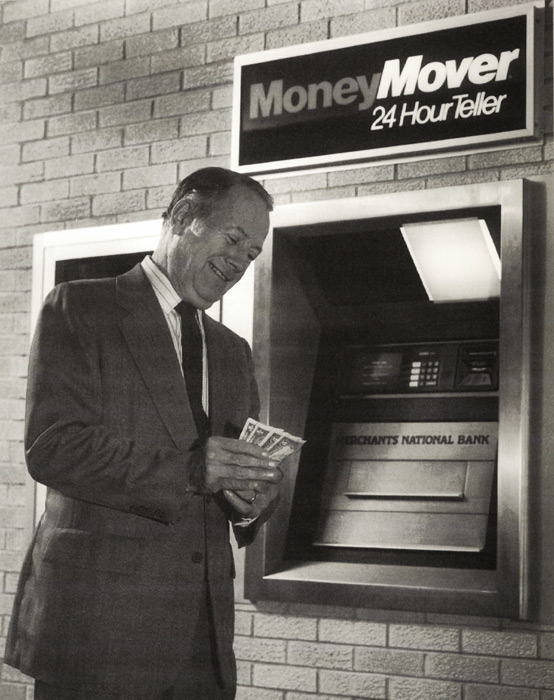

Through this period of change, the bank continued to adapt and evolve. Technological advancements, both in terms of service delivery and internal operations, accelerated. Convenience technologies, such as electronic funds transfer and ATMs, were implemented,

making the bank's services more accessible.

Through this period of change, the bank continued to adapt and evolve. Technological advancements, both in terms of service delivery and internal operations, accelerated. Convenience technologies, such as electronic funds transfer and ATMs, were implemented,

making the bank's services more accessible.

In 1985, the bank set the stage for its era of acquisitive growth by making the fundamental decision to search for opportunities to acquire other banks that had similar community interests, management cultures, and high performance. The first of these acquisitions took place in 1988 with the acquisition of Pendleton Banking Company (Pendleton, Ind.).

First Merchants Corporation took another significant step "designed to improve the marketability" of its stock by having its common stock listed and traded on the NASDAQ market in 1989.

In 1991, the company completed the acquisition of First United Bank (Middletown, Ind.) and then renamed The Merchants National Bank to First Merchants Bank later the same year. The name change matched that of the holding company, and more importantly, it allowed for a distinct identity within the market and beyond.

The company continued to expand in East Central Indiana in 1996 with the acquisitions of Union County National Bank of Liberty, Ind. and The Randolph County Bank, N.A (Winchester, Ind.).

And in 1997, the Corporation announced that it had passed $1 billion in assets.

Michael L. Cox was named President of First Merchants Corporation in August 1998. The move was part of the plan for the orderly succession of senior management in the Corporation in anticipation of the retirement of Stefan S. Anderson as Chief Executive Officer in 1999.

First Merchants Corporation continued to expand in East Central Indiana in 1999 by acquiring First National Bank of Portland (Portland, Ind.), Anderson Community Bank (Anderson, Ind.), and Madison Community Bank.

As expected, Mr. Anderson retired in April 1999, and Michael L. Cox was named Chief Executive Officer and President of the Corporation, completing an orderly and well-planned succession.

Early in 2000, the Corporation welcomed Decatur Bank & Trust Company (Decatur, Ind.) to its affiliates. Decatur Bank comprised four offices located throughout Adams County, had assets of $128 million,and was established in 1966.

The Corporation then acquired Frances Slocum Bank and Trust Company, N.A. (Wabash, Ind.) in July 2001 — significantly expanding its service area within East Central Indiana.

With the acquisition of Lafayette Bank & Trust Company in April 2002, the Corporation significantly expanded its market area into West Central Indiana. Lafayette Bank & Trust Company — with $750 million in assets — substantially increased the Corporation’s assets to $2.7 billion.

Merchants Trust Company, N.A., a new wholly owned subsidiary of the Corporation, was formed on January 1, 2003. The Trust Company united the trust and asset management services of all the Corporation's affiliate banks. It became one of the largest trust companies in Indiana, with assets of more than $1.3 billion.

The acquisition of Commerce National Bank (Columbus, Oh.) in March 2003 marked the Corporation's entry into Central Ohio and established a promising base for future growth in the Columbus area.

Following several notable mergers of bank charters and consolidations in 2005 and 2006, the newly unified First Merchants Bank became the largest bank headquartered in Indiana as of April 2007.

Following the annual meeting of shareholders in April 2007, Michael L. Cox retired as President & CEO of First Merchants Corporation. As planned, Michael C. Rechin succeeded Mr. Cox as President & CEO on April 24, 2007.

The acquisition of Lincoln Bancorp (Plainfield, Ind.) in 2008 established an ideal foundation for further growth in the Indianapolis metropolitan area and Central Indiana.

2010s – Present

In 2012, Shelby County Bank (Shelbyville, Ind.) was acquired

by First Merchants— expanding market share and presence in Shelbyville, Ind.

In 2012, Shelby County Bank (Shelbyville, Ind.) was acquired

by First Merchants— expanding market share and presence in Shelbyville, Ind.

First Merchants continued its proven acquisition growth strategy with the acquisition of Citizens Financial Bank (Munster, Ind.) in 2013 — expanding market share and presence in Northwest Indiana and Eastern Chicago areas.

In 2014, the acquisition of Community Bank of Noblesville supported a focus on growth in the rapidly growing market of Hamilton County, Ind.

2015 marked two exciting and significant acquisitions of community banks, with Ameriana Bancorp (New Castle, Ind.) and Cooper State Bank (Columbus, Oh.) both merging with and into First Merchants Corporation.

First Merchants continued to gain market share and strengthen its presence in Central Indiana and the fast-growing Hamilton County, Ind. with the acquisition of Ameriana Bancorp.

With the acquisition of Cooper State Bank in 2015, the Corporation expanded its presence in Columbus, Ohio — one of the fastest-growing cities in the Midwest. Cooper State Bank and First Merchants' existing Columbus, Ohio franchise, known as Commerce Bank , were rebranded to First Merchants, unifying the Corporation’s brand in Columbus, Ohio.

Over the next six years, First Merchants continued its organic and acquisitive growth by continuing to serve its personal and commercial customers with attentive and personal service and by completing strategic acquisitions of community banks with high performance and strong community ties.

In 2017, the company expanded into the Fort Wayne, Ind. market by acquiring Independent Alliance Bank (iAB) (Fort Wayne, Ind.). It also acquired The Arlington Bank (Columbus, Oh.), strengthening its growing presence in Columbus, Oh.

First Merchants rebranded its existing Lafayette, Ind. area franchise in 2018, then known as Lafayette Bank and Trust, to First Merchants Bank, fully unifying the company as First Merchants Bank.

First Merchants entered into the southeast Michigan market in 2019 with the acquisition of Monroe Bank and Trust (Monroe, Mi.) and surpassed $10 billion in assets.

Hoosier Trust Company (Indianapolis, Ind.) joined First Merchants Private Wealth Advisors, which expanded First Merchants’ trust and investment management services business in Indianapolis.

President and CEO Mike Rechin retired effective December 31, 2020. On January 1, 2021, First Merchants' Chief Operating Officer/Chief Financial Officer, Mark Hardwick, became CEO and First Merchants' Chief Banking Officer, Mike Stewart, became President.

First Merchants continued to expand in southeast Michigan with the 2022 acquisition of Level One Bank (Farmington Hills, Mi).

From early beginnings in Muncie, Ind. through its current multi-state Midwestern footprint, First Merchants has focused on serving personal and commercial customers through superior and attentive service.